26

June 2025

Understanding asset classes

Thomas Berry

Head of Sales,PSG Wealth

The start to 2025 has seen a notable shift in market conditions, with volatility proving to be the only constant. Recent months serve as a stark reminder of how unpredictable markets can be, particularly in the face of geopolitical tensions, changing monetary policies, and broader macroeconomic developments such as tariffs. In such an environment, asset allocation and diversification are vital tools to assist investors in navigating market turbulence while aiming to reduce risks and capitalise on emerging opportunities.

When it comes to growing wealth over time, diversification through exposure to various asset classes is essential to achieving financial goals. By understanding the different asset classes and how they interact, investors can build more resilient portfolios throughout the market cycle, while working towards their desired outcomes. Diversification across asset classes isn’t merely a technical strategy – it’s a fundamental approach to long-term financial success.

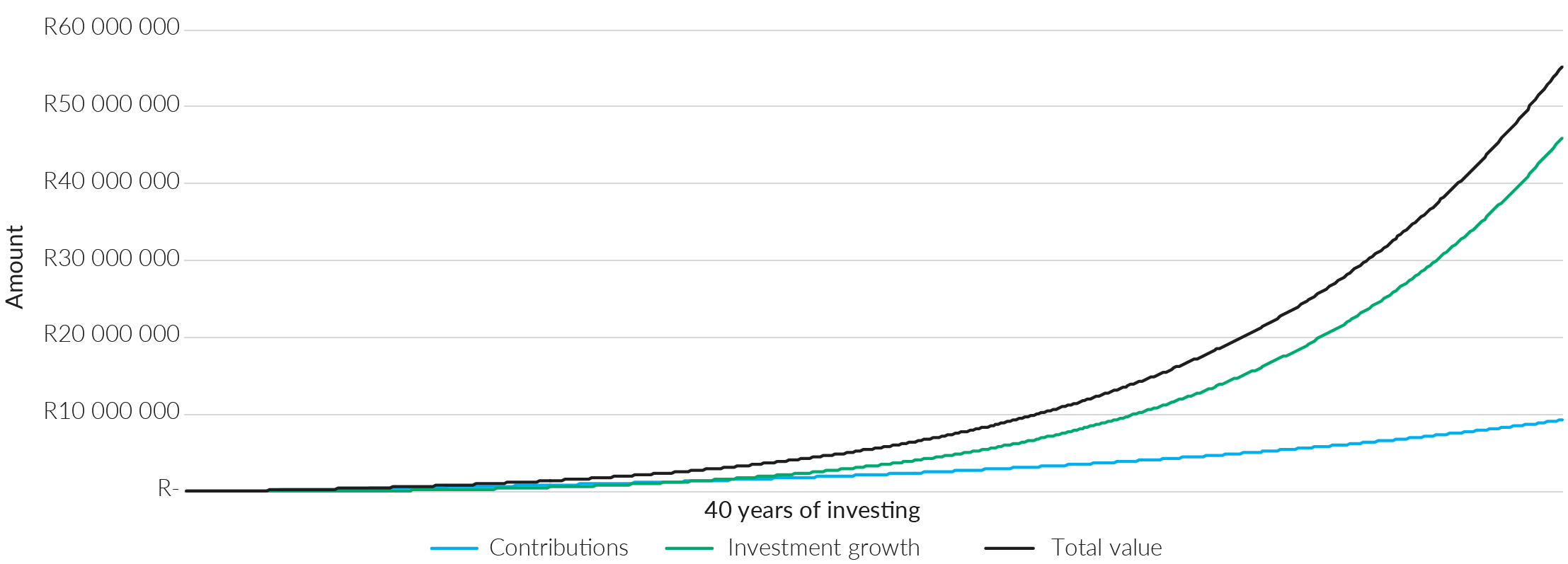

Benefits of compound interest

In the previous edition of The Wealth Perspective, I touched on the power of compound interest and how the benefits become more pronounced over time. A simple illustration of the benefits of starting to invest early is shown below.

Benefits of compound interest

Assumptions: Monthly debit order amount of R5 000, debit order increases by 6% per annum, investment growth of 10% per year over an investment period of 40 years.

The importance of asset classes to meet investment needs

Let’s focus on asset classes and the role they play in a client’s portfolio. Each asset class offers a unique risk-return profile and responds differently to factors like economic conditions, interest rates, inflation, and geopolitical events. The primary purpose of incorporating various asset classes in a portfolio is to enhance diversification, which, when done correctly, can reduce overall portfolio volatility and help protect capital across different market conditions.

Asset classes are categories of investments that share similar features and tend to react in comparable ways to economic conditions. The five primary asset classes each play a distinct role in portfolio construction.

Equities

Equities represent ownership in a publicly listed company. When you purchase a share of a listed company on a stock exchange, you become a partial owner, which means that you share in the company’s profits and losses. You can invest in large-cap, mid-cap and small-cap companies on any listed exchange, such as the Johannesburg Stock Exchange. The primary role of equities in a portfolio is to provide long-term growth that outpaces inflation. Through equity ownership you are also able to further diversify across sectors, such as financial services or telecommunications, as well as geographic regions, including South African or international markets.

Commodities

Commodities are assets such as gold, oil and natural gas, and have prices that are predominantly driven by supply and demand, geopolitical events and broader macroeconomic trends. Commodities often serve as a hedge against inflation and typically exhibit a low or negative correlation with other asset classes with specific portfolio characteristics.

Real estate (property)

Investment in physical property or indirect exposure through real estate investment trusts (or “REITs”) includes exposure to residential, commercial, industrial, and infrastructure property. Real estate is generally influenced by interest rates and economic cycles and, over the longer time, has delivered long-term appreciation with relatively stable cash flow, although it remains sensitive to interest rate changes and cyclical downturns.

Fixed income (bonds)

These are debt instruments issued by governments, municipalities or corporates where investors lend money to the issuer in return for periodic interest payments. Bonds can vary in nature based on their credit quality, for example, investment grade versus high-yield bonds. From a portfolio perspective, a key metric is duration, which measures a bond’s price sensitivity to changes in interest rates. As a result, it estimates the weighted average time it takes to receive all coupon and principal payments and serves as a proxy for how much a bond’s price will fluctuate when yields change. Bonds tend to have lower volatility than stocks and are often negatively correlated with equities during periods of market stress, making them a key diversifier within a portfolio.

Cash and cash equivalents

These are typically highly liquid, low-risk instruments that are easily tradeable. Of all the asset classes mentioned, they generally offer the lowest returns due to their short-term nature and minimal volatility. This asset class is generally used to provide liquidity and stability during market volatility.

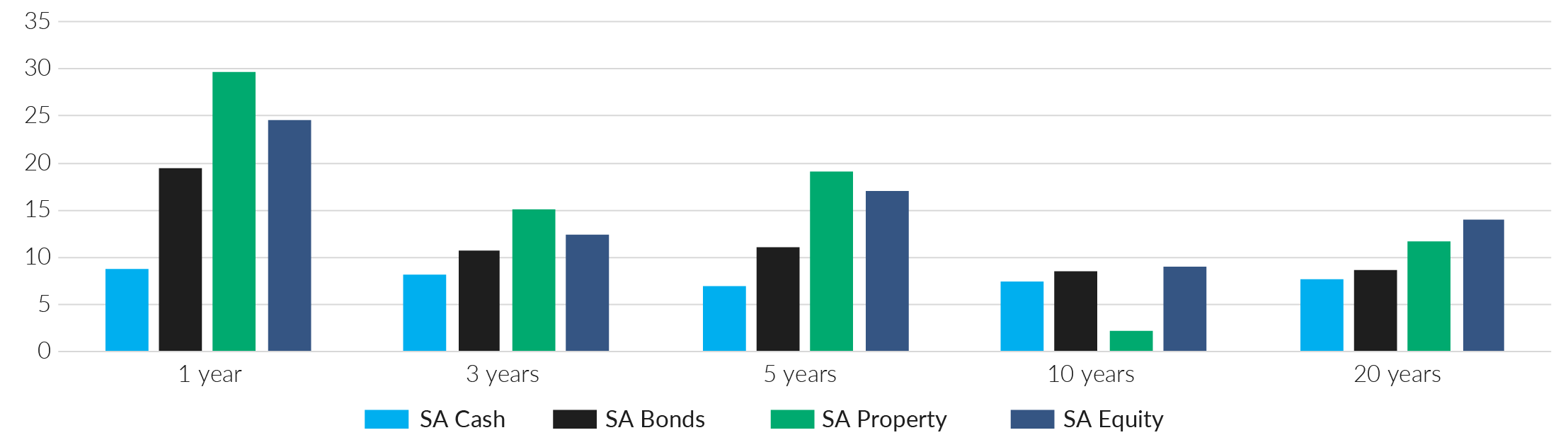

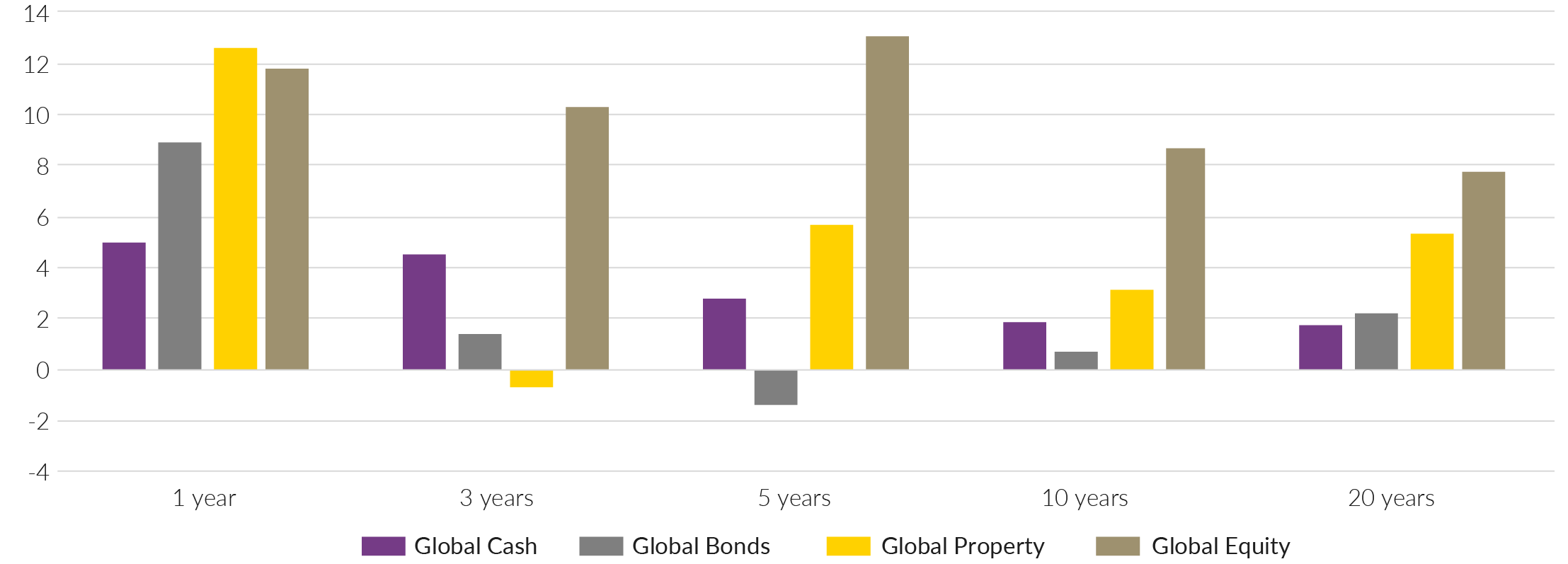

Asset class performance over time

The graphs below highlight how various asset classes have performed over time. They offer a clear view of long-term investment trends for local and global assets, measured in rands and US dollars respectively.

Annualised asset class returns (ZAR)

Annualised asset class returns (USD)

Diversification through asset classes

Diversification across asset classes remains one of the most reliable strategies for successful investing. Each asset class contributes something unique to portfolio construction and wealth creation – from the high growth potential of equities to the income and safety offered by bonds and cash equivalents. Understanding how these assets move in relation to each other assists you in building portfolio that’s not only positioned for growth, but that is also resilient through market cycles.

Start investing early, diversify wisely and – through a well-constructed portfolio – allow time and discipline to help you achieve your desired investment goals.