04

June 2025

Reserve Bank eases policy amid benign inflation and tepid growth outlook

Adriaan Pask

Chief Investment Officer, PSG Wealth

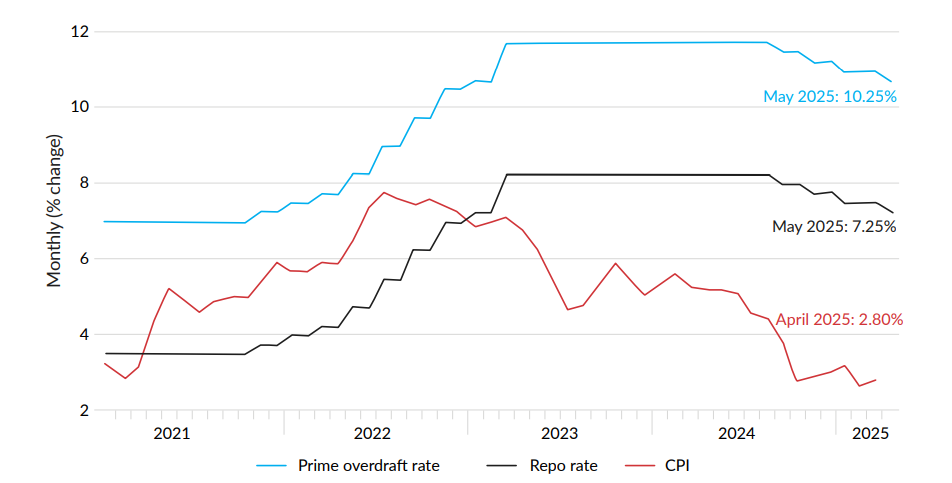

On Thursday, 29 May 2025, the South African Reserve Bank (SARB) adopted a cautiously dovish stance, lowering the repo rate by 25 basis points to 7.25% — a decision that aligned with market expectations in light of muted inflationary pressures and an increasingly subdued economic outlook. All six members of the Monetary Policy Committee supported the rate reduction, with one advocating for a deeper 50 basis point cut. The decision comes against a backdrop of faltering indicators in key sectors such as mining and manufacturing, as well as rising unemployment.

Reflecting this deterioration in economic momentum, SARB also revised both its inflation and growth forecasts downward. According to Trading Economics, the SARB now anticipates inflation to average 3.20% in 2025, down from its previous estimate of 3.60% in March. The 2026 forecast was also revised lower to 4.20% down from 4.50%, citing a more favourable starting point, softer global oil prices, a firmer rand, and the cancellation of previously proposed VAT increases.

The inflation forecast for 2027 has similarly been trimmed to 4.40%, from 4.50%. Economic growth projections were not spared either. The Bank cut its 2025 growth estimate from 1.70% to 1.20%, citing mounting downside risks and persistent structural weaknesses. Nevertheless, the broader outlook for structural reform remains cautiously optimistic, suggesting some potential for mediumterm recovery. SARB Governor Lesetja Kganyago noted that inflation remains well contained, with headline consumer price inflation having fallen below 3% in April, and core inflation resting at the lower bound of the Bank’s 3%–6% target range.

The downward revision in inflation projections — now 3.20% for 2025, 4.20% for 2026, and 4.40% for 2027 — signals potential scope for further monetary policy easing should conditions continue to permit. As quoted by Business Day, Governor Kganyago commented: “We see balanced risks to this forecast,” indicating a measured approach going forward.

Interest rate versus CPI Monthly

Source : Business Day

Source : Business Day

Bottom Line

The economic growth outlook has been under pressure in recent weeks with most forecasts being revised down across the globe. Rate cuts in South Africa is aimed at stimulating growth, but whether they will be sufficient in the absence of larger reforms to underpin more sustainable growth remains to be seen.

Macroeconomics in brief

Macroeconomics in brief

Key Market Indicators

Select a tab to navigate

- Loading data...

- Loading data...

- Loading data...