10

April 2024

Global economic expansion gains momentum in March

Adriaan Pask

Chief Investment Officer, PSG Wealth

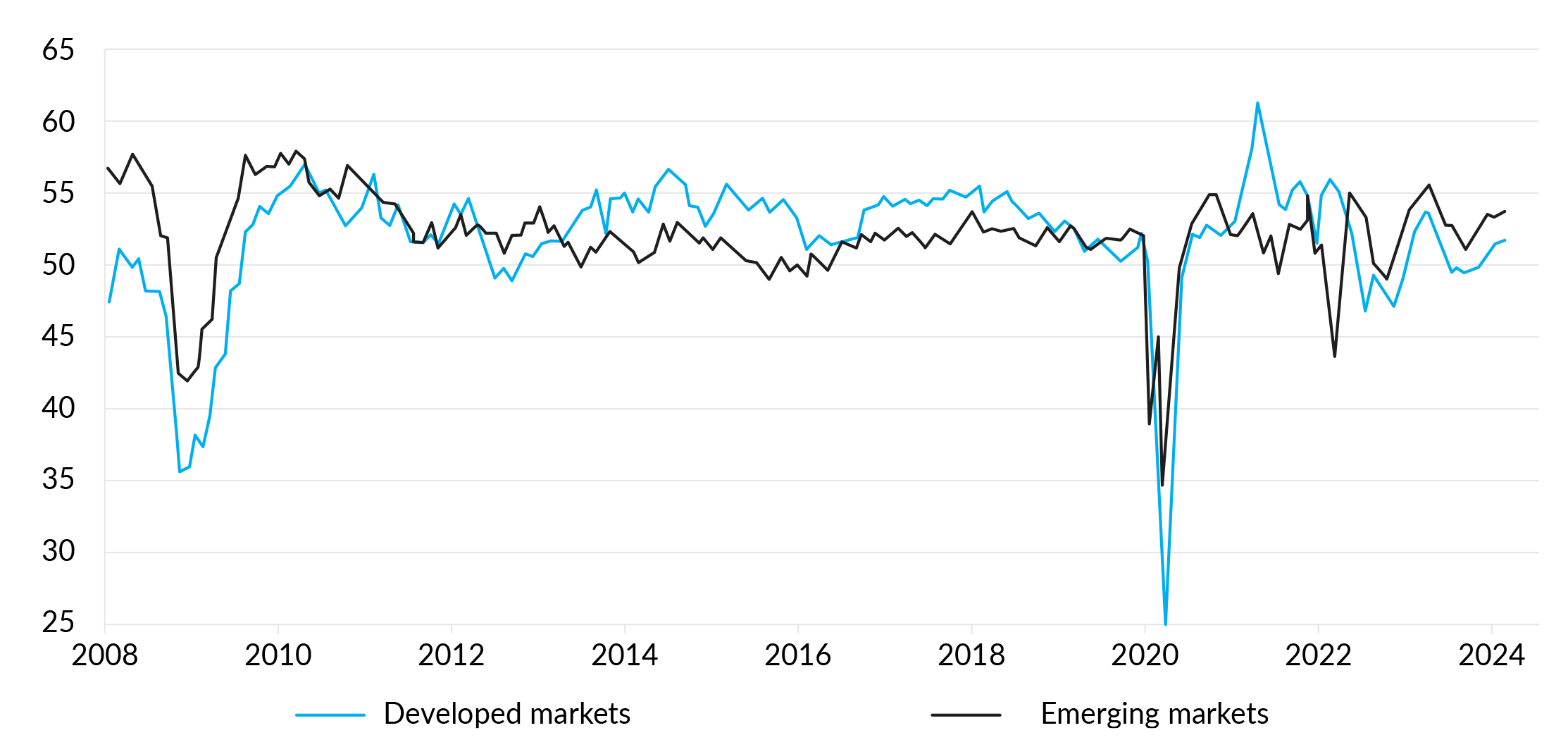

Global economic growth continued to pick up steam in March 2024, according to the latest PMI surveys conducted across the globe. This brought the expansion’s speed to its strongest level since June 2023, with the recovery also growing more widespread, both by sector and geography. “At 52.3 index points, up from 52.1 in February 2024, the headline PMI covering manufacturing and services in over 40 economies hit a nine-month high to signal an accelerating expansion at the end of the first quarter. Historical comparisons indicate that the latest PMI reading is broadly indicative of the global economy

growing at an annualised rate of 2.60%,” S&P Global reported.

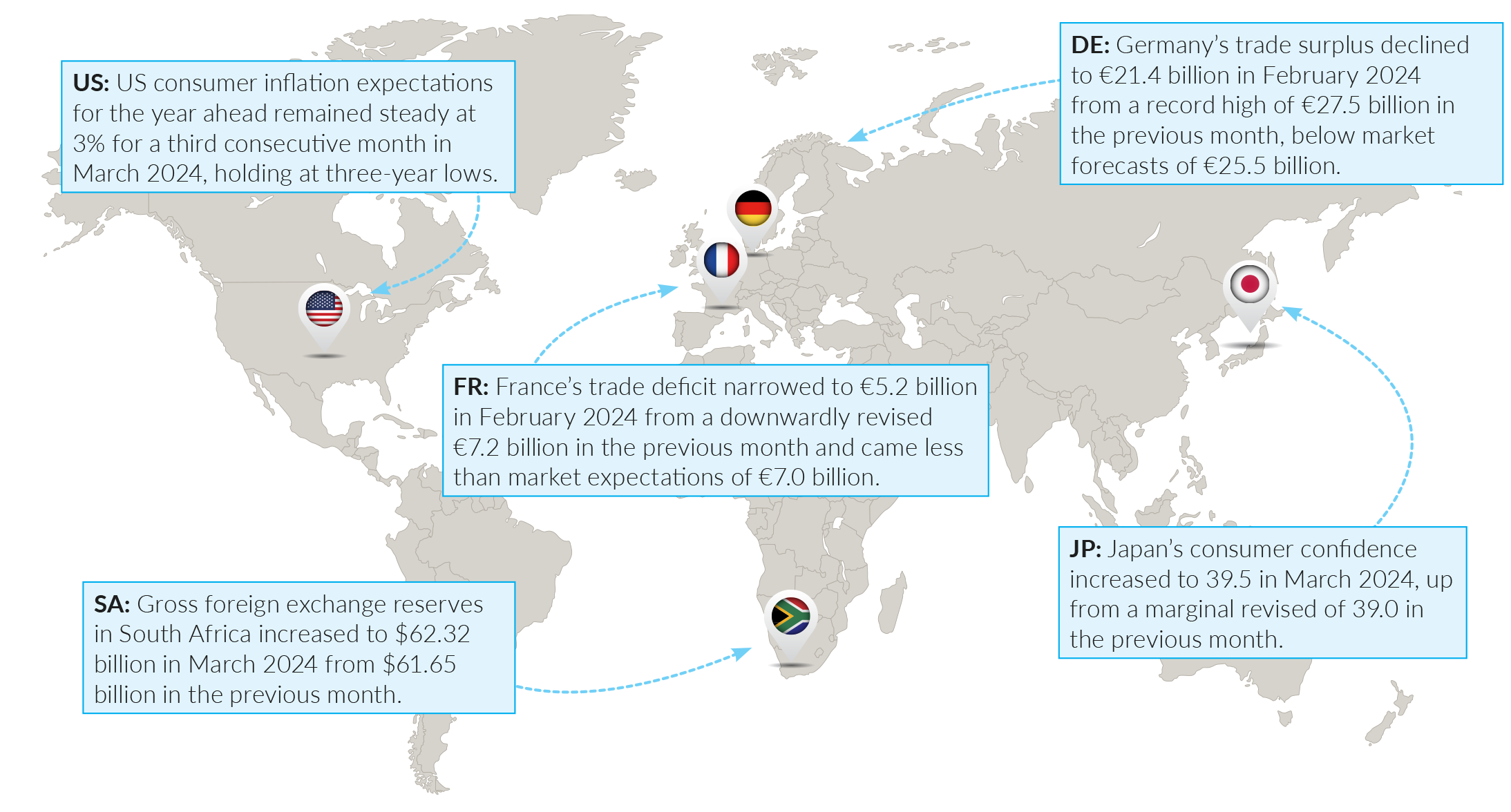

Meanwhile, global new orders increased at their fastest rate in more than two years in March 2024. An almost stable decrease in orders for items exported globally—the lowest in 25 months—helped spur the demand rebound.

By market, emerging economies collectively reported the strongest growth in 14 months, while developed economies reached the highest growth rate in nine months. Business activity growth in developed markets was led by the UK and the US, while Japan saw the highest monthly output gain since September 2023.

Meanwhile, the Eurozone saw its output rise for the first time since May 2023, albeit at a very slow pace. Canada defied the general trend of expansion and remained in contraction as output fell due to additional declines in both manufacturing and services.

Regrettably, as global economic growth continues to recover, PMI selling price inflation looks steadfast. According to a recent S&P Global report, March 2024 saw a much quicker global increase in average prices for goods and services, indicating that consumer price inflation will remain sticky in the coming months. “Upward price pressures were primarily linked to increased labour costs and were most evident in the UK and

US. However, March also saw some renewed upward pressure on prices from both raw material costs and strengthening demand, the latter adding to firms’ pricing power. Energy, in contrast, remained a downward driver of prices on average globally.” The service sector continues to experience the most pressure, with prices rising at a rate significantly higher than the average observed before the pandemic while reporting the

sharpest price increase for eight months globally at the end of the first quarter.

Be that as it may, forward-looking indicators have improved overall, suggesting that the upturn will accelerate in the second quarter. Two significant forward-looking indicators added to the positive sentiment in March.

First, new business inflows climbed for the fifth month in a row in March 2024, pointing to faster demand growth for both commodities and services.

Second, companies’ predictions for next year’s output increased to a nine-month high in services, holding close to a one-year high in manufacturing.

Global PMI output by market

Source : S&P Global PMI

Source : S&P Global PMI

Bottom line:

The more positive outlook has a meaningful impact on commodity prices and domestic equities. For the time being, it seems that US recession fears have receded somewhat which is broadly positive for growth assets.

Macroeconomics in Brief

Macro Economics 10 April 2024

Key Market Indicators

Select a tab to navigate

- Loading data...

- Loading data...

- Loading data...