12

June 2024

Shoprite has the best margins and the most effective management, but its sheer size limits the potential for industry growth.

Vaughan Henkel

Head of Securities Solutions, PSG Wealth

Analyst recommendation

| Counter | Share price | Intrinsic value | Upside/downside |

| Shoprite Holdings Ltd | R251.12 | R236.79 | 5.7% Downside |

As at 12 June 2023

Executive Summary

This is the pre-eminent food retailer in South Africa, with the best margins and the most effective management, but

its sheer size limits the potential for above industry growth (even market share gains will become limited) and its

valuation is full.

2. Key points in the investment thesis are:

a. Good revenue growth of 13.9%, however, this was mainly driven by acquisitions as like-for-like revenue growth

was 6.5%.

b. The large impact of load shedding with the yearly cost estimated at R1bn for FY24. This was better than the

worst-case scenario of R1.8bn, however, it is still large enough to impact margins.

c. Net store expansion of 285 stores in the 2023 calendar year with 105 liquor stores the main additions. 75

Shoprite stores were added, and 33 pet stores were added, almost doubling 2022 pet store locations.

d. Official food inflation was 8.7% for 1H24 with Shoprite’s internal inflation of 8%.

3. Have an intrinsic value of R236.79 per share (downside of 5.7%) and recommend a hold position.

a. In our base case we have an exit multiple of 12.5 times in line with the 10-year average.

b. Looking at EBIT growing at Cagr 9.3% between FY23 to FY25 driven by price increases, store growth and lower

food inflation.

c. Small downside on valuation due to stretched multiples that remain higher amongst industry peers and history.

d. The intrinsic value has increased since the last note from R212 to R236.79 on the back of half year results and

continued market share gains. Shoprite continues to impress on both the business execution as well as navigating

a tough macro-economic environment and thus we have increased our expectations going forward. It is the

dominant food retailer, but we believe this is already reflective in the current share price.

e.

4. What would make us change our minds?

a. Price rerating to more normalised levels.

b. Inflation returning to normal allowing management to execute on price control thereby allowing a more balanced

price-mix.

c. Improvement in macro environment in South Africa, such that employment growth returns

Analyst thesis

- The company has access to a unique asset through its higher than peers’ concentration helium reserves combined with plans for material future growth.

- Currently, we see the price as expensive considering the material risks which include: a. The complexity of exploration and development of gas fields (operational risks) with operational success becoming crucial as debt gets utilised (debt covenants).

- The capital intensiveness of exploration and development of gas fields requires significant capital with the risk of dilution enhanced with the current lower share price.

- Catalysts of operational success or maximum production capacity can only be verified by FY27.

- The going concern risk regarding management’s main assumption depends on obtaining the relevant funding and successfully completing phase 2.

- Steps towards completing management’s EBITDA guidance of between R5.7 billion and R6.2 billion (not expected before the financial year 2027), would serve as potential catalysts and would increase our bull case probability (currently 10% on the bull case). These include a. Obtaining the required financing without material dilution or costs while meeting debt covenant requirements. (R1 billion from the sale of a 10% stake in Tetra4 and $150 million (R2.6 billion) share issue with our expectation now pushed out to FY25. A $260 million (R5 billion) share issue is expected during the 3-year construction period). b. Providing evidence to reach the guided phase 2 production volumes of 4 200 kg per day of LHe and 34 400 gigajoules (GJ) per day of LNG (estimated 2027 calendar year). c. Realising LHe prices of $600 per MCF and LNG of R250 per GJ, having had no adverse exchange rate movements and storage, distribution and dispensing costs not being material.

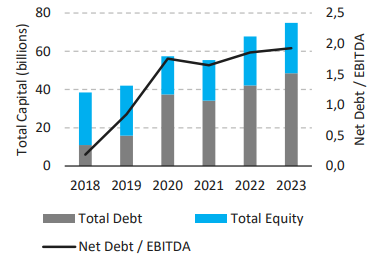

Valuation

Table 3: Valuation

Table 9: Valuation multiples

Source: FactSet

Graph 3:

Source: FactSet

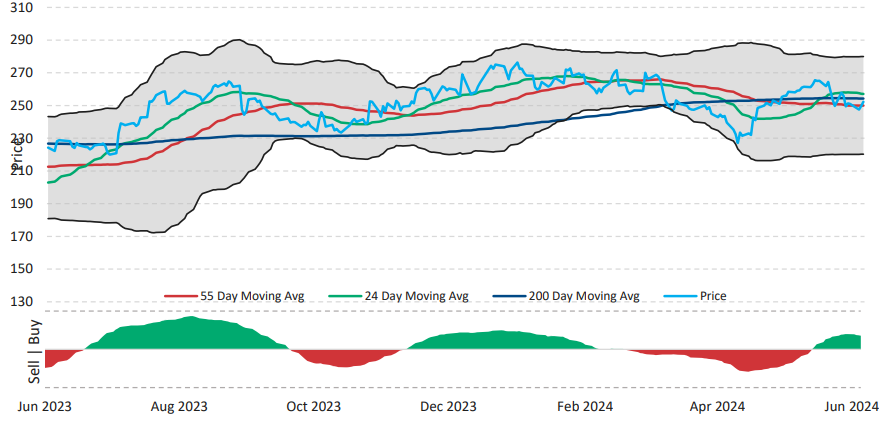

Graph 5: Shoprite Price Momentum

Source: FactSet