03

December 2024

Renergen: Expenses continue to outpace revenue as part of the early life cycle phase

Vaughan Henkel

Head of Securities Solutions, PSG Wealth

Analyst recommendation

Sell

| Counter | Share price | Intrinsic value | Upside/downside |

| REN-ZA | R8.42 | R7.8 | 7% downside |

As at 28 November 2024

Executive Summary

Renergen released its financial statements for the six months ended 31 August 2024 on 31 October 2024. We note the

below highlights and remaining concerns:

1. Even though revenue increased by 8%, losses for the period increased by 63%. This is due to expenses ramping up

quicker due to less capitalisation and increases relating to higher operational activities.

2. There were 2 388 tonnes of LNG produced during the period, in line to the 2 386 tonnes produced in 1H24.

Delivering its first container of helium to its customer remaining a key priority for management.

3. We hope to see details soon regarding the Nasdaq listing due to it being a crucial funding requirement and creating a

risk of potential share dilution. As per the 8 March 2023 circular, the listing was expected to occur during the third or

fourth quarter of 2023. However, we are pleased to see that Standard Bank of South Africa was appointed as a joint

underwriter of the Nasdaq IPO indicating some potential progress being made.

We maintain our intrinsic value at R7.8 as the one year of discounting was offset by us extending our forecast by a

year due to the delays.

Analyst thesis

1. The company has access to a unique asset through its higher than peers’ concentration helium reserves combined with

plans for material future growth. Growth could potentially benefit from higher gas prices relating to risks of gas

shortages in South Africa.

2. Currently, we see the price as expensive considering the material risks which include:

a. The complexity of exploration and development of gas fields (operational risks) with operational success becoming

crucial as debt gets utilised (debt covenants).

b. The capital intensiveness of exploration and development of gas fields requires significant capital with the risk of

dilution enhanced with the current lower share price.

c. Catalysts of operational success or maximum production capacity can only be verified by FY27.

d. The going concern risk regarding management’s main assumption which depends on obtaining the relevant funding

and successful completion of phase 2.

3. Steps towards successfully completing management’s EBITDA guidance of between R5.7 billion and R6.2 billion (not

expected before financial year 2027), would serve as potential catalysts and would increase our bull case probability

(currently 10% on the bull case). These include obtaining the required funding and reaching production volume

guidance.

Results

Table 1: 1H25 Results summary

| Metric (R'000) | 1H24 | 1H24 | Y/Y % |

| Revenue | 23 757 | 25 609 | 7.8 |

| Gross profit/loss | 10 760 | 882 | -91.8 |

| Other operating income | 150 | 16 383 | >100 |

| Share-based payments expense | -4 622 | -1 748 | -62.2 |

| Other operating expenses | -67 428 | -80 643 | 19.6 |

| interest income | 4 888 | 5 450 | 11.5 |

| Interest expense and imputed interest | -8 892 | -25 198 | >100 |

| Loss for the period | -43 504 | -70 713 | 62.5 |

| Cash used in operating activities | -12 974 | -42 549 | >100 |

| Cash flows used in investing activities | -169 688 | -91 696 | -46.0 |

| Proceeds from share issue | 32 581 | 0 | -100 |

| Proceeds from disposal of interest in subsidiaries | 0 | 0 | - |

| proceeds from borrowings | 373 972 | 177 973 | -52.4 |

| Repayments of borrowings (capital) | -58 653 | -348 720 | >100 |

| Loss per share (cents) | -29.91 | -45.73 | 52.9 |

Source: Company financials

Valuation

Table 3: Valuation

Table 6: Valuation multiples

Source: FactSet

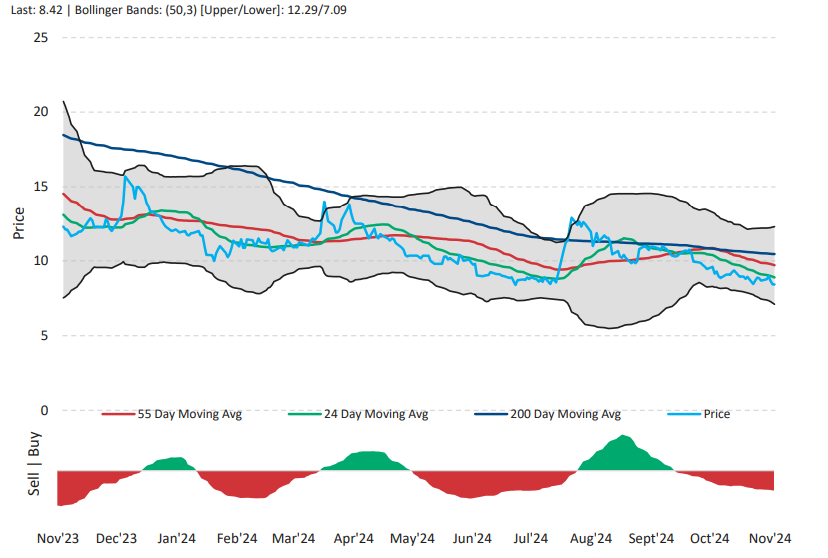

Graph 5: FSR Price Momentum

Source: FactSet