12

February 2025

Trump administration supports share price gain as tariffs and menthol ban revocation supports American sale expectations

Vaughan Henkel

Head of Securities Solutions, PSG Wealth

Analyst recommendation

Hold

| Counter | Share price | Intrinsic value | Upside/downside |

| British American Tobacco | £33.90 | £34.08 | 0.5% Upside |

As at 10 February 2025

Executive Summary

1. After two years of declining cigarette volumes, the revocation of the menthol ban should mitigate declining

volumes, although negative volumes are still expected.

Analyst thesis

- Key points in the investment thesis are:

a. Management states that illicit vapour in the US account for 60% of sales. The FDA is moving too slowly

at the frustration of management. Aim for 50% smoke-free products by 2035.

b. US cigarette sales surprised on the downside with volumes down in the low teens single digits in the

past 18 months. This was against the expectation of 3-5%. Going forward it is expected at low single

digits, and the revocation of the menthol ban should help.

c. £900m in share buybacks expected in FY25. Net Debt/EBITDA expected to be below 2.5x upon results

on 13 February which should prompt additional buyback plans.

d. NGPs still growing strongly and have turned to a profit, and BATS has the highest market share in both

vapour and Tobacco Heated Products.

e. Company sitting on a dividend yield of 7% and forward PE of 9.3, 50% lower than Philip Morris.

Results

Source: Sources: FactSet and company financials

On 25 July 2024, British American Tobacco released half year results for FY24.

1. Total revenue declined 8.2% to £12.3 billion, but down 0.8% when adjusted for currency movements due to the exit of the Russia/Belarus segment and weaker than expected risk reducing products segment. DEPS was up 13.8% due to lower interest and tax costs as well as lower shares due to the buyback program.

2. The US combustibles segment is a concern. The expected volume decline of 3%-5% a year seems low as the half year number was down 13.7% relating to a number of factors.

3. Modern Oral was the highlight with revenue up 122% albeit off a low base.

4. NGPs have started contributing to profits following loss making periods previously.

5. Operating margins to remain steady at just under 45%.

6. Total new categories (Vapour, THP & Modern Oral) to continue to be impacted by illicit vapour in the US. Could see a surprise following the announcement of a retraction of the menthol cigarette ban in the US. This will be a continuing theme going forward.

7. Net Debt/EBITDA of 2.5x with closer to 2.2x expected by the end of FY24.

8. Guidance remained unchanged and share buybacks continue. Management has guided £700m in FY24 and a further £900 million in FY25.

Valuation

Table 3: Valuation

Table 5: Valuation multiples

Source: FactSet

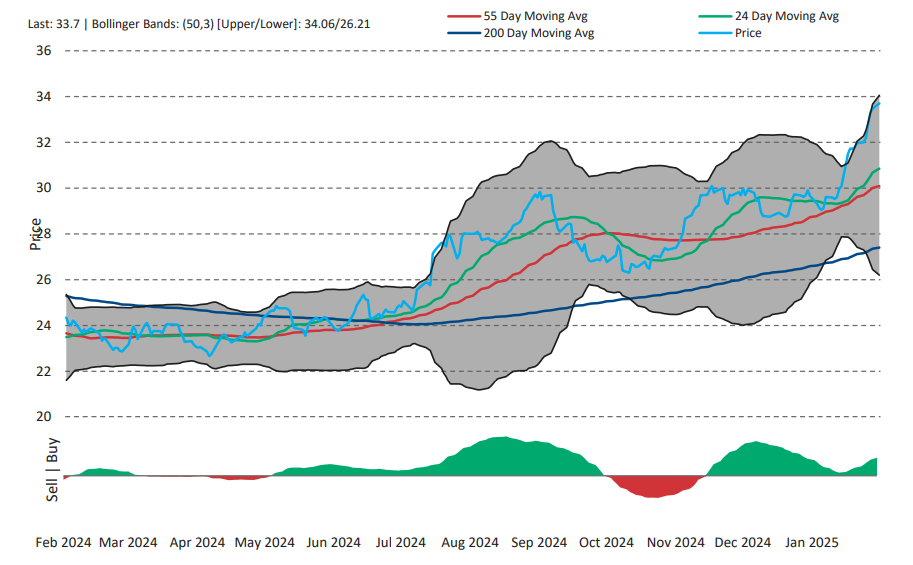

Graph 5: FSR Price Momentum

Source: FactSet