26

June 2025

Understanding the underlying instruments of investment products

Linda Kleynscheldt

Head of Actuarial and Product,PSG Wealth

In the previous edition of The Wealth Perspective, we explored choosing the right product (or investment vehicle) to support your journey towards your destination of financial freedom. However, the investment world also has various different investment instruments that form the underlying foundation of the product/s you select. In the same way as buying a car involves choosing a type of vehicle and then deciding on a specific brand or model, investing entails selecting both the type of product and its underlying investment instruments. The investment instruments refer to the types of funds or asset groups in which you invest.

Types of investment instruments

The main types of investment instruments available to investors are explained below.

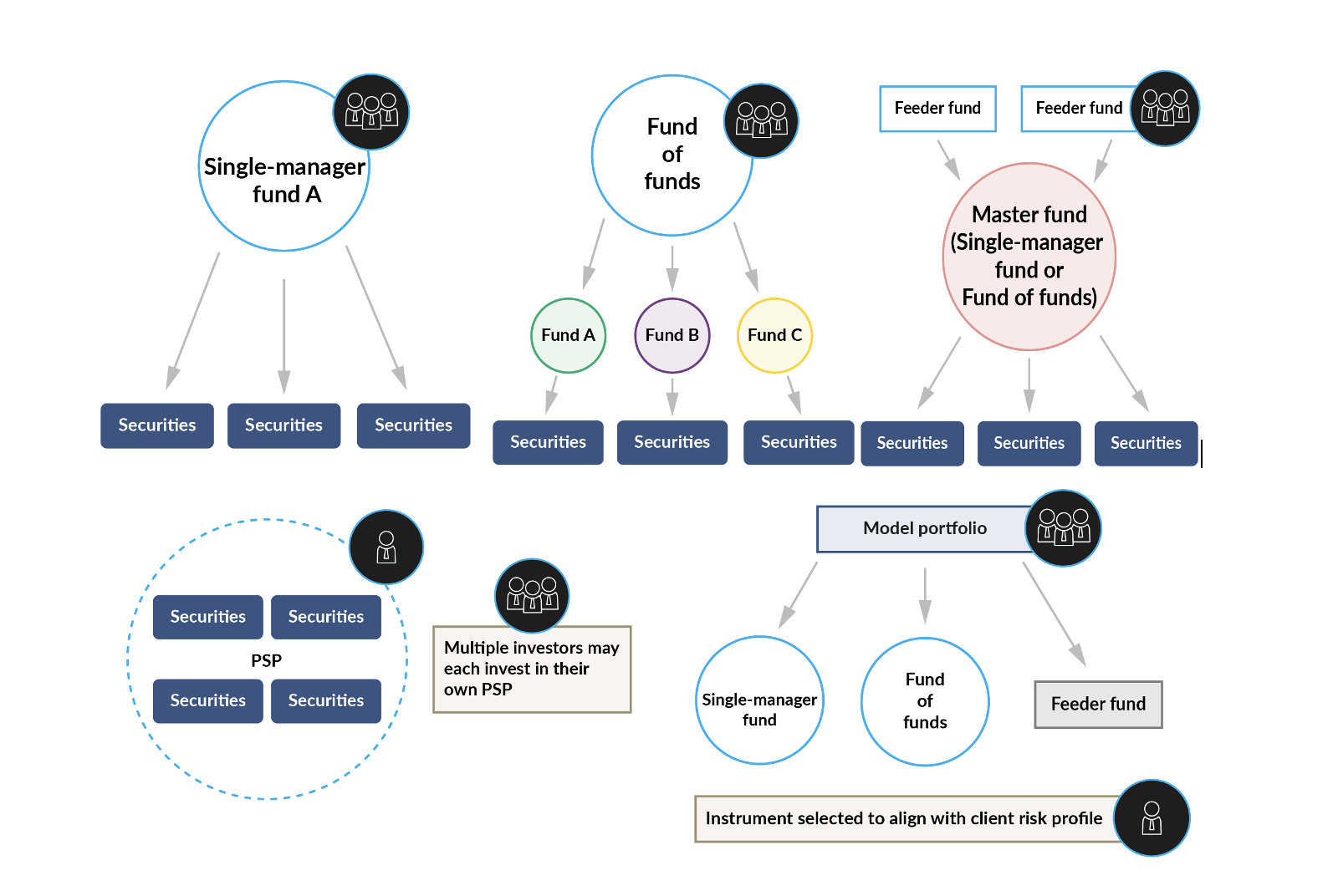

Single-manager unit trust funds

In this type of investment instrument, one investment management company selects and manages all the investments in the fund. Consequently, all investment decisions are made by a single team that follows a consistent investment philosophy and specialises in a focused set of asset classes or markets.

Funds of funds

A fund of funds is a diversified portfolio that invests in several other collective investment schemes (also referred to as unit trust funds). This contrasts with the approach of single-manager unit trust funds, which invest directly in assets like shares or bonds. Exposure to multiple underlying funds offers additional diversification across different fund management styles. As with the single manager, who may change the holdings in the fund, a fund of funds manager may change the relative holdings in the underlying unit trust funds over time.

Feeder funds

Feeder funds are typically South African investment funds that invest primarily into a single ‘master fund’. In the South African context, the master fund will often be an offshore ‘parent fund’, giving local investors cost effective access to international markets while investing in rands. A feeder fund instrument offers investors an opportunity to tap into broader market opportunities, providing additional diversification benefits, which aids in managing risk.

Personal share portfolios (PSPs)

A PSP is a customised portfolio of directly owned shares managed specifically for an individual investor, rather than pooled funds like unit trusts. Clients can set up these instruments with the help of suitably qualified and registered advisers.

Model portfolios

A model portfolio is a constructed blend of investments determined by a professional fund manager. These portfolios typically include collective investment schemes and pooled funds and are designed to match a specific investment approach or benchmark. In some ways they are similar to funds of funds, but they take a more tailored approach, as they are designed around a specific view of a financial adviser in support of their clients’ needs and risk profile.

Factors to consider when selecting an investment instrument

To select the right instrument, it is important to understand the different ways in which they are constructed. The first factor to consider is your investment goal – basically, what are you trying to achieve? Answering this question will guide you in terms of your need for diversification, the level of risk you can take, the fees you can afford and the time horizon you have available to achieve your goal.

Secondly, consider how much you want to be involved in the various decision-making processes. Often referred to as active and passive management in the context of a specific fund, this concept could also be applied in the choice of the type of instrument. Considering the definitions provided above, it is clear that the various investment instruments have varying levels of involvement in making decisions about market selection and the combinations of investments needed to gain diversification.

The financial industry is tasked with the process of ‘Know Your Client’, but it is just as important for clients to know themselves. Seeking guidance from a trusted adviser and someone with the suitable expertise and experience is key to selecting the right investment instruments that form the basis for your selected product.

As a quick guide, the following main questions should be considered:

- Your investment goals – would you like to preserve funds and avoid fluctuations, or do you put more value in higher growth or income potential?

- How much time to do you have available to achieve your goal? This is often referred to as the investor’s time horizon.

- How much risk can you take and how much tolerance do you have for market fluctuations?

- The answers to the three questions above will determine your need for diversification, which is a further guiding factor.

- What are the fees? It is important to note that different fee structures apply to the various investment instruments. Some fees depend on the value of assets, others on the volume of transactions, and still others on the number of parties involved in the investment process. Various tools, including EAC statements, are available to aid investors in gaining a full and transparent view of the fees involved. Ultimately, these fees impact the net returns achieved.

- Tax implications. Taxes may differ depending on the investment instruments you select. A tax practitioner can provide you with more information in this regard.

Investors need to be aware of restrictions applicable to investment instruments:

- There are regulatory limits on asset classes within certain products. For example, if a fund of funds instrument is designed for retirement investments, Regulation 28 limits will apply. Regulation 28 is the section of the Pension Funds Act that limits the level of investment in specific asset classes within a retirement fund.

- Some instruments will require a minimum investment level. This will typically be higher for PSPs than for funds of funds or single-manager funds.

- There could be liquidity constraints that result in instruments having lock-in periods.

- Finally, there may also be access limitations. For example, certain more sophisticated instruments may carry higher costs and only be viable investment options for high-net-worth individuals or qualified investors.

Take the first steps

Choosing the correct investment vehicle can seem daunting at first. Start with the basics and soon you will find yourself confidently progressing on your investment journey, with the assurance that you have chosen the right path.