30

June 2022

The confluence of macro and stock factors is the sweet spot

Vaughan Henkel

Head of Securities Solutions,PSG Wealth

To identify opportunities in equity markets, both locally and abroad, involves a bottom-up approach best described as value/quality enhanced with a macro overlay that refines our idea identification and exposure.

We start with the bottom-up factor identification we review for each equity opportunity we analyse

Our bottom-up process considers 14 factors – including growth, valuation, dividend yield, issuance (of stock), catalysts, earnings quality, moat, management and governance, balance sheet, risks, regulation, environmental, social and governance (ESG) (constantly

evolving), and momentum of both price and earnings (timing tools). It is an extensive list, and while some factors require in-depth investigation, others are simple but crucial. Below we highlight a few of these factors.

Growth

Growth is the core of any investment opportunity and is seen in the context of growth relative to the price paid. This section can be the subject of entire books (and is).

However, the fundamental reason for equity investments is growth (relative to price), meaning its long-term valuation rating. Changes, like those in the venerable P/E, are largely immaterial in the return shareholders receive. Using the S&P 500 Index as an example, we note that it is driven by earnings and how earnings grow over the long term.

Catalyst

A catalyst is a factor that has the potential to alter the investment thesis for a particular investment materially. Moreover, the analyst needs to identify it before the wider market, so the opportunity can deliver a return as it becomes widely known. The combination of the two factors (identification and timing) is very difficult to get right, but when achieved, it delivers.

Moat

The moat is probably the most difficult factor to define. Essentially, it is a competitive edge that is sustainable, enduring and allows for superior returns on capital to remain elevated over time. This means it limits the competition from reducing superior returns.

The two questions that should be asked here are:

1. What is the moat?

2. How sustainable is it?

The moat may be a patent, brand or an intellectual process that cannot be competed away. It is difficult to pinpoint the definition and support of the moat, as it is a qualitative view of a range of factors.

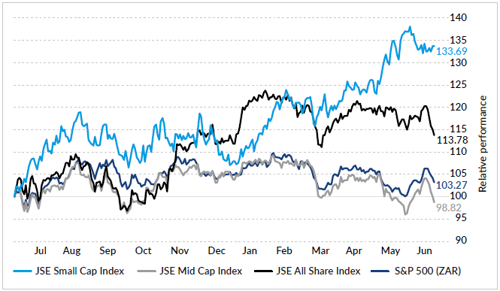

The recent performance of SA Inc has been underwhelming

Especially when compared with the broader SA Index (ALSI) and S&P 500 Index (ZAR). SA Inc shares appear to be cheap and trade virtually at the same levels they did over a year ago.

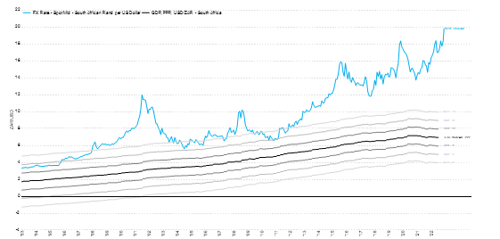

Electricity generation from Eskom is structurally lower and at levels last seen in the early part of the millennium when generation was trending in the opposite direction. The private sector has already started implementing solutions to lower its dependence on this failing state-owned enterprise (SOE). There are estimates that private companies may add more than 4 000 megawatts of electricity generation by 2024.

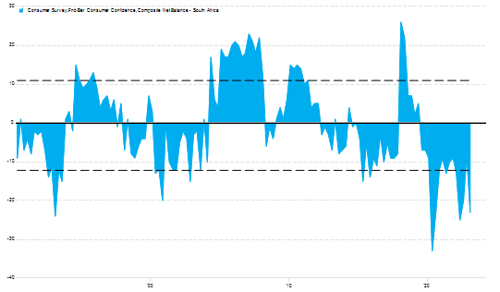

Excluding the period of panic during the pandemic, one would need to go back to the early 1990s for consumer confidence to be lower than the current levels. Combined with low business confidence, these indices suggest that overall confidence in SA is near the bottom.

Often, it is these points of extreme pessimism that provide the best opportunities and have led to these well-known quotes by renowned investors:

· “Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

· “When everyone is selling, be the one to buy. When everyone is buying, be the one to sell.” – Howard Marks

With the heightened negativity partially, fully or overly priced into our market, investors should recognise that it only takes a little bit of good news to reverse the negative momentum and start unwinding the negative relative performance. This is a realistic possibility as attractively valued investment opportunities become scarce, leading to capital flowing from expensive markets, where monetary policies have been accommodating and interest rates low, to emerging markets, which have been relatively overlooked and whose pool of attractively valued investment opportunities become difficult to ignore. Emerging markets have been particularly overlooked over the short term due to the risk-off environment, so they may start to benefit as risk appetite returns.