14

August 2024

Is it time for a fresh look at commodity investing?

Shaun le Roux

Fund Manager - Equity Fund,PSG Asset Management

Is it time for a fresh look at commodity investing?

Commodities are fundamental to the functioning of economies. They play an important role in the South African economy and resource shares are an important component of our stock market. However, as commodities experience multi-year cycles and can be quite volatile, their popularity tends to wax and wane over time.

Nevertheless, we believe there are currently good investment opportunities in the commodity complex and they are underrepresented in most investment portfolios. This is unfortunate, as we think they can play a valuable role as part of a diversified portfolio, given the challenging environment we believe lies ahead.

Commodities are out of favour for multiple reasons

Commodities are deeply out of favour in global markets, and local fund managers have been persistently bearish on commodity prices over the past three years (according to the Bank of America survey). There are a number of reasons for this pessimism, which seem to have become the common consensus:

- Long-term underperformance. The Commodity Research Bureau (CRB) Commodity Index is broadly at the same level as in 2014, meaning commodity prices have declined in real terms over a decade while the US stock market has appreciated sharply over this period.

- Commodity prices are cyclical and volatile. Many investors equate volatility with risk. Demand fluctuates with macro factors such as economic growth and inventory cycles. Commodity shares are therefore regarded as low-quality investments, particularly after a period of underperformance. Low-return, high-volatility assets are seen as toxic.

- The macro environment raises concern around commodity demand. Fears of the US falling into a recession have lingered for several years. The Chinese economy has also faltered and the commodity-intensive property sector has been in sharp decline. China remains the single largest consumer of most commodities.

- ESG concerns hamper investment. The carbon intensity of mining and the push to wean the world off fossil fuels have removed or reduced environmental, social and governance (ESG) conscious investors from the pool of capital providers.

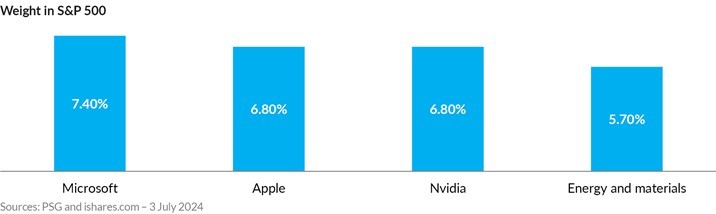

- Commodity shares are now a very small component of most global indices. Global equity markets have become increasingly dominated by passive investors, the US and mega-cap growth stocks. As the chart below shows, the combined weight of energy and materials in US stock indices is dwarfed by individual stocks like Apple (and Nvidia).

- New production locations are not investment friendly. New production increasingly comes from less politically stable jurisdictions like the Democratic Republic of the Congo (DRC).

- Rising global interest rates have raised the cost of capital and the cost of financing physical inventories

History provides a valuable perspective

As students of economic history, however, we believe it is crucial to look beyond the recent experience and interrogate the common consensus. After a careful study of market conditions (and being willing to take a differentiated view), we concluded that commodities are not only likely to do well in the future, but can also fulfil an important role in a diversified portfolio.

If, instead of focusing on the past decade, you zoomed out and looked at the past century, you would observe that there are a few periods where commodities (and other real assets) not only handsomely outperformed financial assets, but also offered portfolio protection against inflation.

The chart above compares the performance of commodity prices to financial assets over the past 120 years. You will notice three periods of distinct outperformance by commodities – the 1930s, 1970s/80s and early 2000s to 2010. It will surprise many who are hardwired to sell off cyclical sectors during an economic downturn, that those periods coincided with economic recessions and even a depression.

As global natural resources investors Goehring & Rozencwajg put it: “While the 1970s and 2000s bull markets are well studied, we were stunned that commodity and natural resources equities did well during the Great Depression.

A simple equally weighted portfolio of energy, base metal and agricultural stocks bought at the market peak in 1929 more than doubled by 1938 compared with the broad market that remained 50% lower. Indeed, owning commodity stocks throughout the Great Depression was the only way to preserve one’s wealth.”

The current environment hints at future outperformance

We think those periods of superior returns from commodities over financial assets were characterised by three key conditions:

- Expensive financial assets at the start of the period. Stock market indices were expensive in 1929, 1969 and 1999 and subsequent returns were poor. Those periods were also characterised by concentrated markets where a select group of stocks came to dominate and drive markets higher.

- Global macro conditions were inflationary.

- The preceding decade had seen very limited investment in the supply capacity of commodity-extracting (old economy) sectors with capital flowing to new economy and financial assets.

We would argue that each of these conditions exists today.

Despite the macroeconomic hurdles outlined above, we think there are a number of drivers of demand that should more than compensate for the potential economic headwinds over the medium term.

The transition to a lower-carbon world is very metal-intensive and the current projections of the metals required to build out the envisaged solar farms, wind turbines, electricity grids and electric vehicles will require significant new green metal capacity.

Furthermore, within developing economies, we may be witnessing the passing of the growth baton from China to other faster-growing nations that are moving up the industrialisation curve in South East Asia (like India or Indonesia), South America, the Middle East and Africa.

Looking a bit further into the future – towards the end of the decade – it is not currently clear how supply will meet the anticipated demand for transition metals like copper. (More on this in the article that follows.) Thus, we expect the markets for most commodities to be tight over the medium term, given the persistence of underinvestment in capacity and likely sources of demand.

Our portfolios are positioned to take advantage of the opportunities

Given healthy fundamentals and low valuations, with stocks trading at very attractive levels relative to likely future cash flows, our clients have relatively high exposure to a number of commodity-related ideas. We have leveraged our global process to identify several opportunities outside of the JSE, especially in the energy and shipping sectors.

We have also taken a non-consensual view that the outlook for the platinum group metals (PGM) sector is favourable from these levels. We think market participants are overly focused on the demand implications of highly optimistic future penetration rates for electric vehicles (EVs).

Positioning is very bearish, and we are seeing all-time highs of investors taking speculative short positions in palladium. We think that after a period of aggressive destocking by purchasers, supply constraints and deficits will force an inflection in the months ahead.

We have also been flagging that the global macro environment calls for a differentiated approach to managing portfolio risk. Whereas many market participants still default to G7 bonds as a means of reducing portfolio risk, we argue that we are in a macro environment in which bonds and equities are likely to be positively correlated.

Real assets are also going to play a very important role in protecting a portfolio against inflation in times to come. We believe that a risk toolkit that is fit for these times means thinking differently about commodities. It is our view that both gold and energy securities offer portfolio protection against many of the likely future macro risks. Accordingly, our clients have healthy gold and energy exposure.

It’s time to think differently about the role of commodities and real assets in your portfolio

Resource stocks can be volatile over the shorter term, but we remind investors that this volatility works both ways and that commodities can offer protection and upside in an environment where expensive, well-owned financial assets start to struggle.