03

September 2025

For multi-asset funds, it’s risk-adjusted returns that matter

John Gilchrist

Chief Investment Officer,PSG Asset Management

Multi-asset offerings are a staple in the retail investment world – and, generally being Regulation 28-compliant, of many retirement funds too. Most investment houses offer some form of a balanced multi-asset fund which blends a number of asset classes into one cohesive portfolio usually aimed at achieving a real return target. While the typical balanced fund – holding up to 75% in equities – is the best-known multi-asset fund, investors these days have a range of funds to choose from in this category, offering various levels of equity exposure.

For many investors, a well-managed multi-asset fund can do a lot of heavy lifting in terms of meeting their long-term objectives, making selecting the right fund a pivotal choice. In selecting a fund, it is easy to think ‘well-managed’ is synonymous with ‘top performing’. But we believe it is crucial to focus on risk-adjusted returns, for some very compelling reasons.

The implicit trade-off investors make when selecting a multi-asset fund

By investing in a multi-asset fund, an investor is making a conscious decision not to invest purely in equities, but opting to invest in a variety of asset classes instead. Over the longer term, multi-asset funds are likely to generate lower returns than pure equity funds. So, the implicit trade-off is that investors are accepting lower returns in exchange for more consistency in performance over shorter time frames, and a smoother investment journey overall. Therefore, we believe anyone invested in a multi-asset fund has consciously upweighted the importance of risk-adjusted returns relative to absolute returns.

Standard measures of risk present some pitfalls

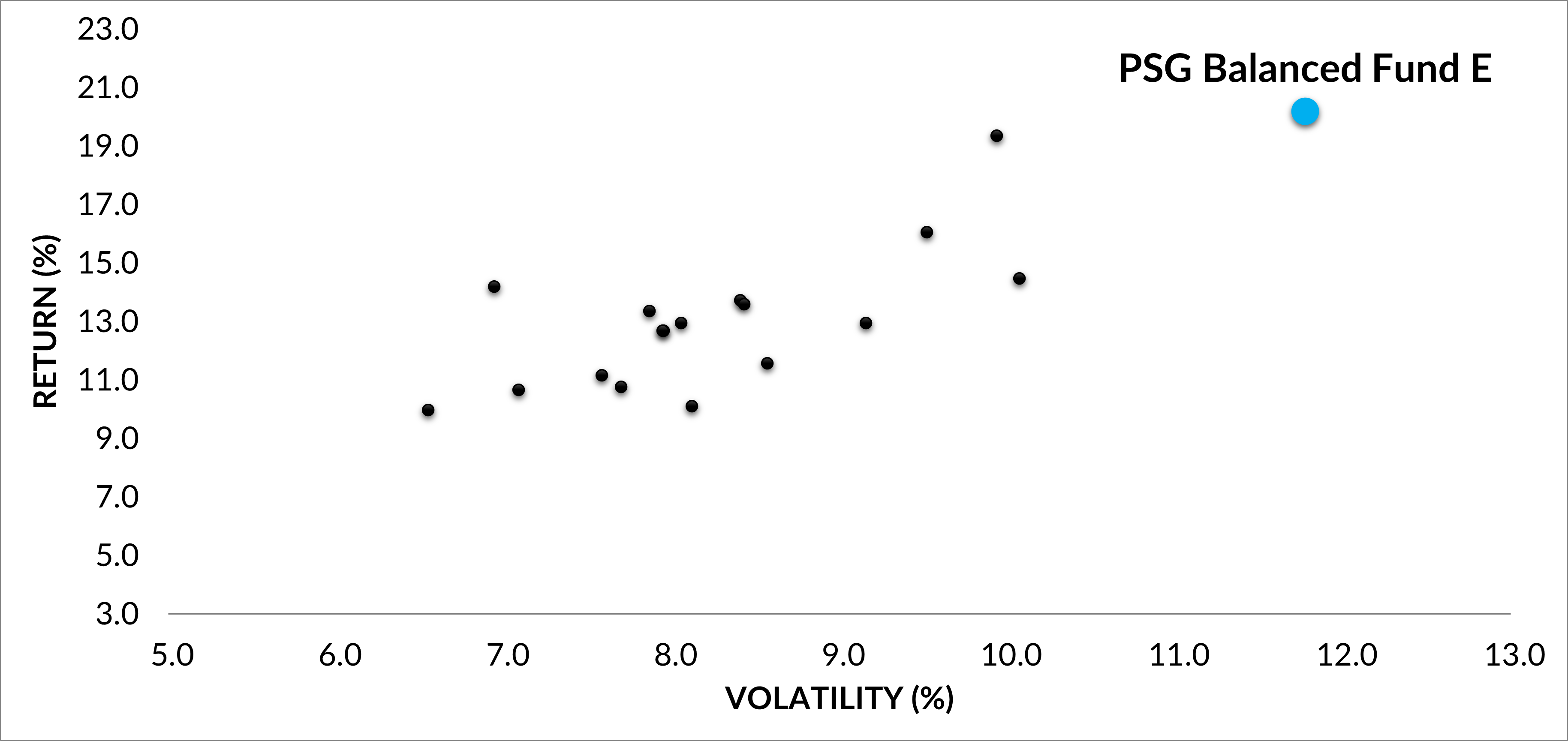

When investment professionals assess multi-asset funds’ performance, their starting point tends to be a traditional risk/return type of graph, like the one below. This graph plots annualised returns versus volatility for various balanced funds including the PSG Balanced Fund over 5 years to June 2025. Volatility is generally viewed as a proxy for risk, and thus at first glance, the PSG Balanced Fund has delivered an exceptional return, but it appears to have delivered this at quite a high level of risk relative to competitors.

PSG Balanced Fund

Return vs volatility over 5 years

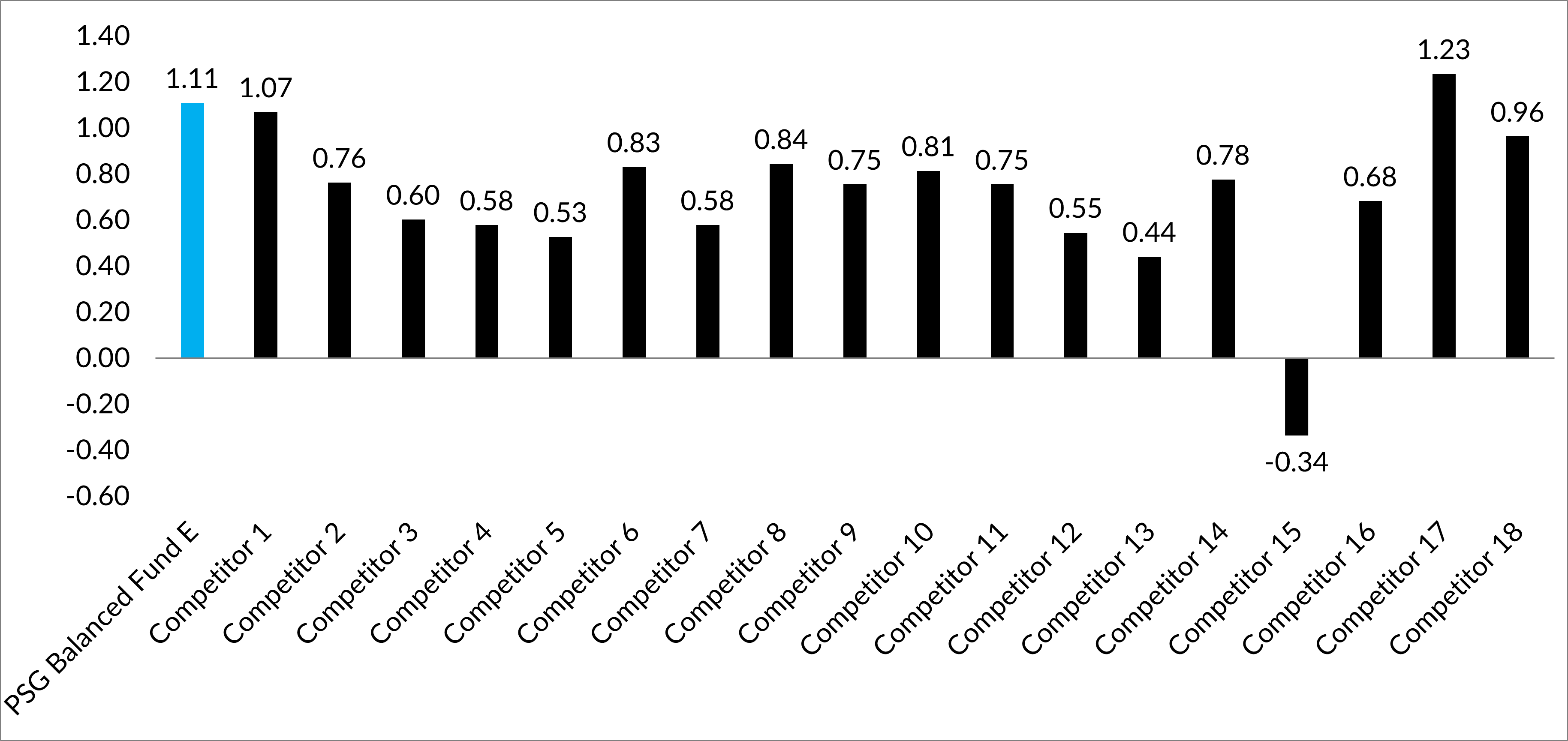

Interpreting the trade-off between returns and risk can be challenging, and a number of measures were developed to assess and compare risk-adjusted returns. A popular measure is the Sharpe ratio, which compares excess returns (returns above the risk-free rate) divided by the volatility. This measure shows that investors in the PSG Balanced Fund are being handsomely rewarded for the level of volatility experienced – on traditional measures, this fund has delivered both excellent returns and excellent risk-adjusted returns.

PSG Balanced Fund

Sharpe ratio (Geo)

However, as we have highlighted before, using volatility as a proxy for risk, while being computationally very attractive, does have some shortcomings: volatility is backward-looking, as it is based on historical data; it does not distinguish between ‘good’ upside volatility and ‘bad’ downside volatility; and it uses monthly data, thereby introducing a short-term focus that may not be appropriate for multi-asset funds with longer investment horizons.

Why we prefer to focus on maximum drawdown as a measure of risk

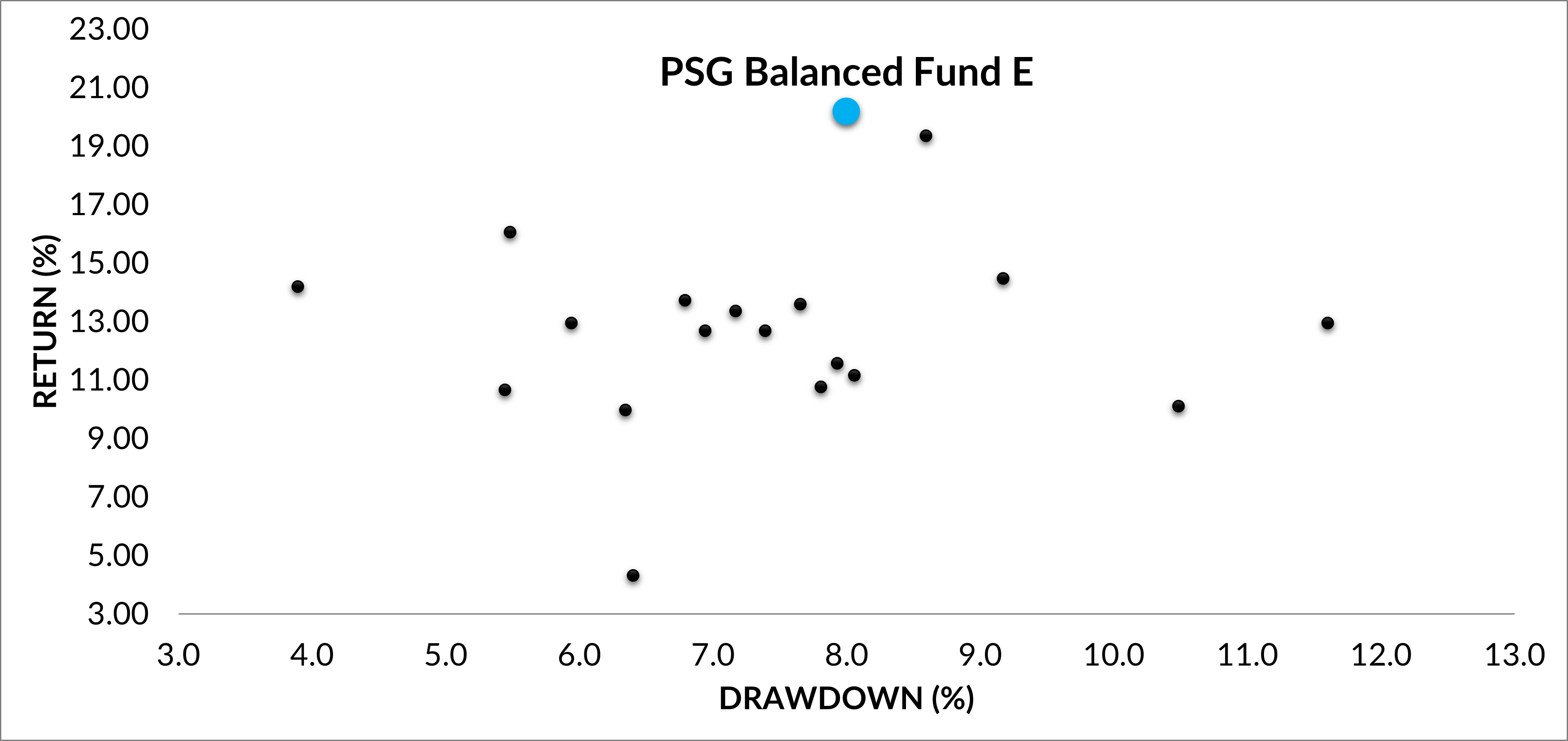

We find that focusing on maximum drawdown is a sensible alternative risk measure, especially given that it is the larger actual losses that inflict pain on investors. By focusing on risk managing overall losses, rather than on managing short-term volatility in the fund, we are able to deliver better long-term returns for our clients at appropriate levels of risk. The graph below shows that we have delivered exceptional returns relative to the maximum drawdown experienced. Despite relatively high volatility, the actual risk experienced as measured by maximum drawdown has been in line with competitor funds.

PSG Balanced Fund

Return vs maximum drawdown over 5 years

Focusing on delivering exceptional risk-adjusted long-term returns for clients

How do we ensure we are well positioned to achieve these objectives for our clients? Firstly, we need to be able to deliver outperformance for clients. As price sensitive investors, we look in uncrowded areas of the market that other market participants have given up on. We then use our 3M investment process to identify overlooked ‘gems’ (i.e. underappreciated quality companies trading on discounted valuations). Doing so successfully requires patience and extensive independent research. Secondly, we need to construct our portfolios in such a way that they meet clients’ risk requirements. Our portfolios are constructed to exploit numerous uncorrelated sources of return. Derivative hedges are used when deemed appropriate and fairly priced. We make extensive use of ‘what if’ scenarios and stress tests to understand how different components will behave in different scenarios. As part of this process, we challenge conventional thinking on historic correlations, especially when valuations are distorted. Importantly, we are willing to be different to the average competitor, delivering important diversification benefits along the way. We believe that by consistently applying our proven methodology, we are well positioned to deliver on our clients’ long-term investment objectives and add value to their portfolios in the long run.

Watch our videos about multi-asset fundsWe recently released two videos that shares deeper insights into how we manage our multi-asset funds. Watch this video where I explain our approach to delivering risk-adjusted returns for our multi-asset investors, and this one featuring Head of Equities Justin Floor where he explores what is needed to deliver an award-winning multi-asset offering. Delivering ongoing investment excellenceWe’re proud to be the winner of the Best Overall Performing Multi-Asset Manager over 5 Years award in the 2025 INN8 Invest Diamond Awards. Full details of the awards can be found here. |

John Gilchrist is the Chief Investment Officer at PSG Asset Management.