10

September 2025

Platinum group metals’ supply-side revenge

Gavin Rabbolini

Senior Analyst, Asset Management

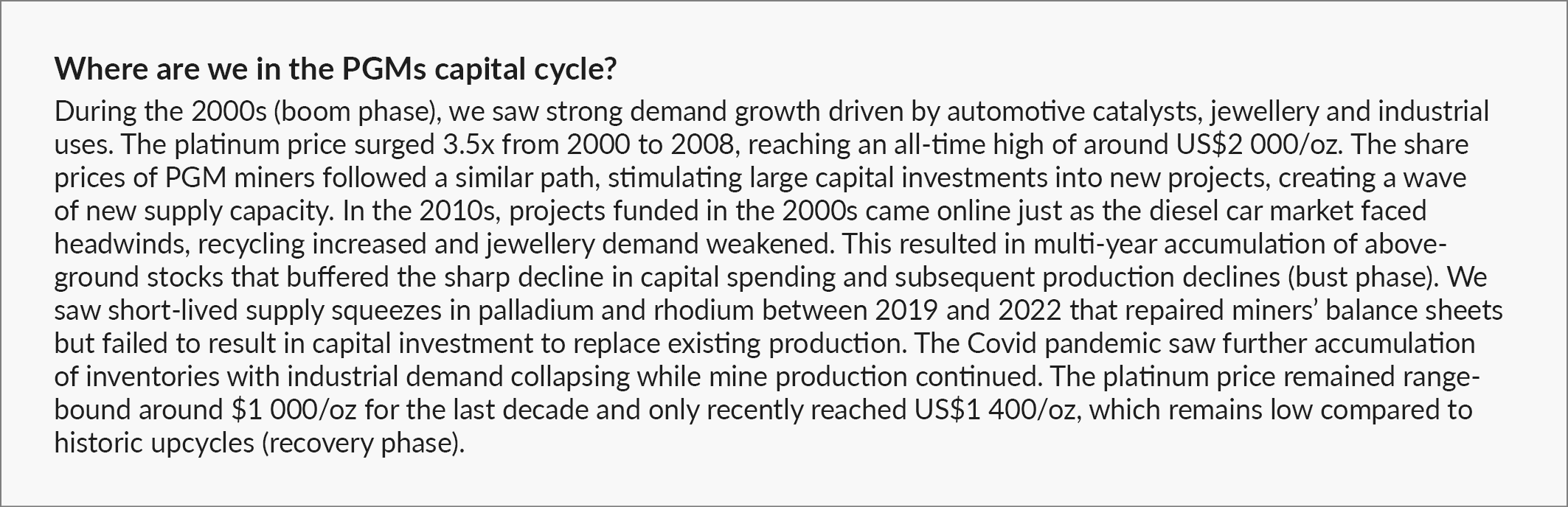

Platinum group metals (PGMs – i.e. platinum, palladium, rhodium, ruthenium, iridium and osmium) make for a fascinating case study when it comes to capital cycle investing. When looking at the capital cycle, supply-side dynamics are often overlooked in favour of more near-term (and visible) demand-side drivers. We believe a thorough understanding of the capital cycle supply side can provide many advantages when it comes to delivering long-term returns for our investors, and PGMs are no exception.

Platinum group metals (PGMs – i.e. platinum, palladium, rhodium, ruthenium, iridium and osmium) make for a fascinating case study when it comes to capital cycle investing. When looking at the capital cycle, supply-side dynamics are often overlooked in favour of more near-term (and visible) demand-side drivers. We believe a thorough understanding of the capital cycle supply side can provide many advantages when it comes to delivering long-term returns for our investors, and PGMs are no exception.

The hare and the tortoise: the inevitability of supply-side constraints

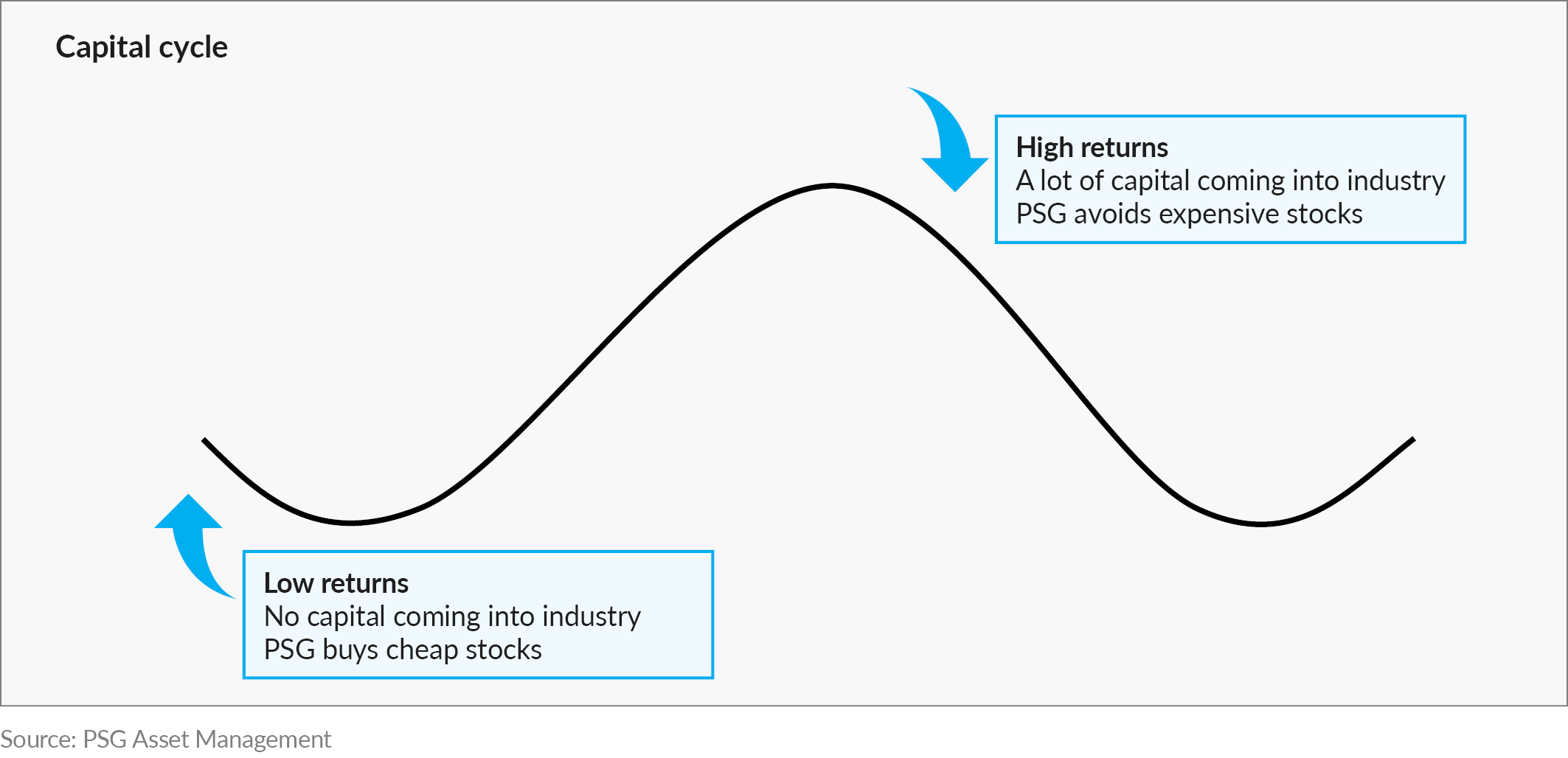

Industries with favourable supply-side dynamics have typically provided a rich hunting ground for long-term, countercyclical investors like us. Capital cycles play out over several years, and being caught on the wrong side of the cycle can be extremely painful. However, supply-side constraints ultimately result in multi-year inflections in pricing power and earnings, leading to significant potential returns for investors who have the patience to wait.

We previously shared our views on the shipping industry (see this article and this video) from a capital cycle perspective. Supply cycles in the shipping industry are far shorter than those that characterise PGMs. The shipping supply side tends to be much more responsive as ships can be scrapped in tough times, resulting in a positive cash flow event for the ship owner. In contrast, PGMs have longer and deeper capital cycles as the economics of deciding to close a mine or shaft are complex, and the decision is fraught with social and political difficulties. Also, it takes a lot longer to build a new mine than it takes to order new ships, and there are also significant regulatory and environmental challenges. In addition, platinum and to some extent palladium (the largest components of the PGM basket) have industrial uses, but also serve as investment assets, complicating their analysis.

A capital cycle perspective of a sector that’s very relevant for the SA economy

Roughly 70% to 80% of global PGM primary production originates from South Africa and the sector is a material contributor to the local economy. Importantly, PGM supply has been in decline for the past 15 years. South Africa’s platinum production peaked at 5.3 million ounces (Moz) in 2006. Since then, capital investment into new mines has added around 2 Moz of new supply. However, by 2025, total production is expected to be just 3.6 Moz. Declines in older mine production have more than offset new supply added in the past 20 years. In the box below, we delve into more detail on the PGM cycle.

The PGM basket of metals has been in deficit for the past three years, with demand being met by running down above-ground accumulated holdings. The unsustainable nature of this situation and the tightening market have received little attention given the bearish narrative around the impact of electric vehicles (EVs) on future PGM demand (especially palladium).

We aim to invest at the stage of the capital cycle when low returns on capital result in reduced supply. Profits will be low and share prices depressed at this point (making it psychologically difficult to buy). Although our clients owned PGM miners in the past, depressed prices in 2024 gave us another opportunity to buy into these, at a time when we became more confident about supply-demand imbalances despite the prevailing negative narratives about future demand.

Our conviction grew that we were nearing the bottom of the cycle (and prices were unsustainably low), supported by mounting supply-demand deficits, material negative cash flows for a growing part of the industry, and increasing supply cuts. Our analysis indicated future undersupply of PGMs, especially platinum and minor metals, even if we made conservative assumptions around likely demand.

We have seen PGMs’ weighting in the FTSE/JSE All Share Index (ALSI) decline from 10% in 2008 to trough levels of around 1% in 2015. The index weighting as at 31 December 2024 was 3.2%, not significantly above the trough level, indicating that the sector remained well out of favour at the end of last year. We built meaningful positions during these periods of weakness in PGM prices across our equity-centric funds. For example, the PSG SA Equity Fund held an aggregate position of 6.5% (double the index weight) at the end of 2024. This has been a strong contributor to 2025 fund returns.

Patience is often the catalyst

Low prices inevitably serve as a supply-side constraint, and if prices remain depressed for long enough, they can result in the closure of unprofitable mines. However, the time frame for any curtailment is uncertain. Producers’ ability to reduce output proactively is constrained by political and social considerations, not to mention corporate game theory, which leads miners to point fingers at each other’s loss-making production rather than reducing supply for the benefit of the industry. Their first response to lower prices is often to increase production, as higher mine utilisation helps them reduce cost per ounce of production and manage their overall profitability.

Nonetheless, given the favourable starting position as described above, the probability of achieving a good long-term investment outcome rises over time. However, getting your timing right is extremely difficult. Therefore, we prefer to build a long-run thesis that we continue to test, and we are prepared to accept some nearer-term volatility, patiently waiting as industry and market dynamics unfold.

PGM prices have recovered sharply this year

Year to date, we’ve seen PGM prices recover in unison, resulting in a 45% increase in the platinum, palladium and rhodium (3E) basket price, which in turn drove a doubling in miners’ share prices off a very low base. Investors also started to warm up to the sector again as market sentiment and news flow turn more positive, which is typical pro-cyclical behaviour during an upcycle.

What has changed?

Firstly, the prevailing platinum narrative has long been that there is enough metal above ground. Recent evidence suggests that these above-ground inventories have been largely depleted. In addition to persistent multi-year deficits doing the heavy lifting, we’ve seen persistent buying from China at higher price levels, and a material spike in platinum lease rates (fees for short-term metal access, signalling a scarcity of physical metal) triggered by incremental platinum stocks that moved from EU vaults to US vaults amid tariff uncertainty.

Secondly, platinum’s secondary supply sources from recycling and investment demand − which plays a critical role in buffering supply-demand imbalances and keeping prices in check − are failing to respond to supply shortages. Recycling capacity and volumes halved from their peak as unsustainably low PGM prices took their toll. Investment demand in physical platinum bars and ETFs has historically acted as metal of last resort to supplement deficits. Investment demand peaked in 2019 and 2020 with cumulative inflows of 2 Moz pushing platinum ETFs' holdings to 4 Moz, and has since shrunk to 3 Moz.

To summarise, we see ongoing solid reductions in mine supply across the PGM basket of metals, with secondary balancing factors unable to respond – low above-ground stocks, weakened recycling, and low investment – resulting in ongoing shortages. This is a very favourable supply-side picture as we look ahead to the next five years.

What could a PGM investment case look like over the next five years?

- Mine-supply side constraints will likely keep building

The accelerated natural attrition in mining supply (decay/depletion in mine production over time) is largely programmed and price insensitive. Given depletion and underinvestment, there will be mine closures over time, irrespective of prices. Lead times for new mines are long, and face multiple regulatory and environmental hurdles.

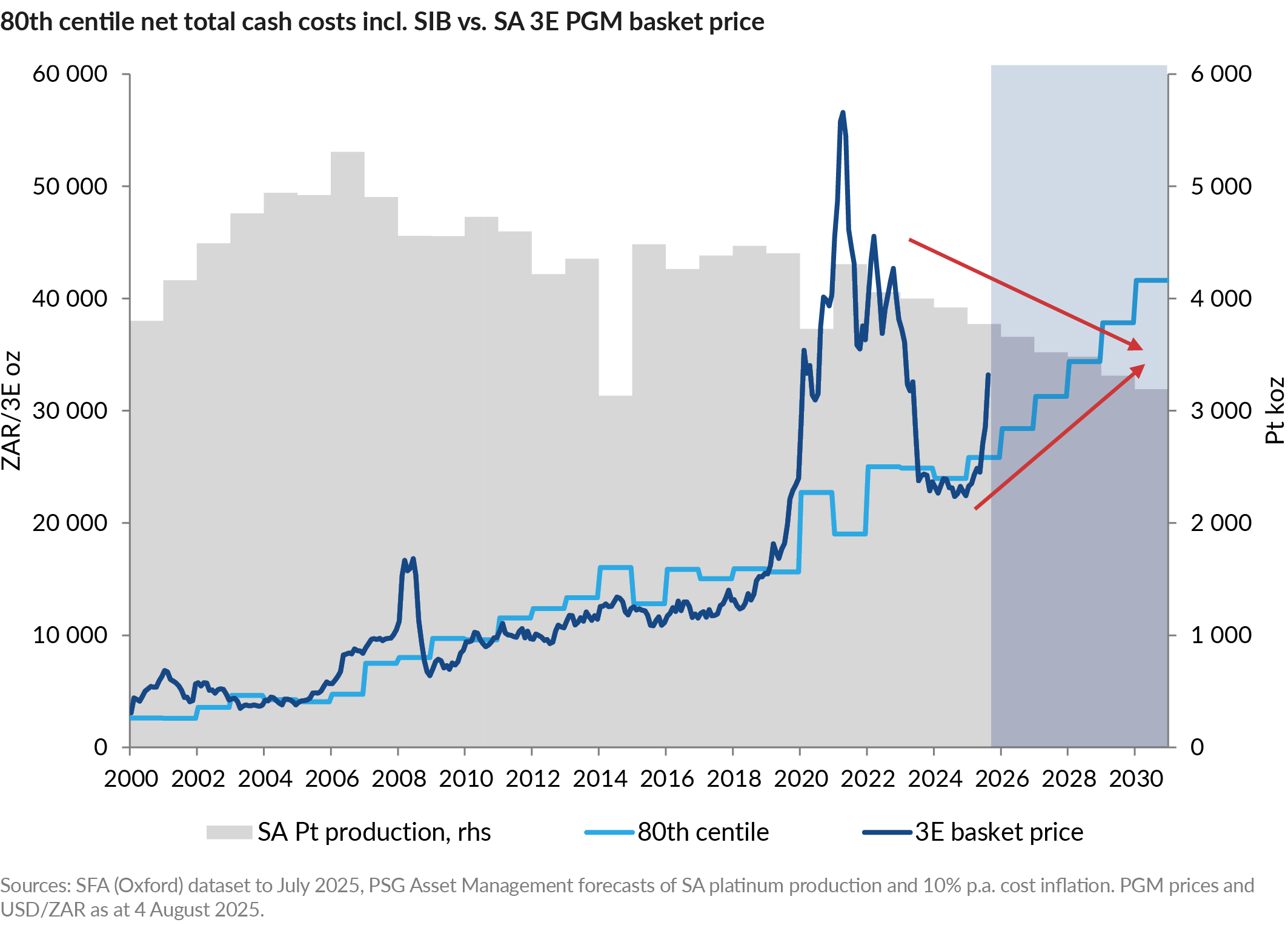

Our research suggests that SA platinum production is likely to fall at the same pace as during the previous decade, from 3.6 Moz today to 3 Moz by 2030. As Norilsk is facing structural constraints to materially increasing supply over the next five years, no meaningful Russian supply response is expected. - Recycling is unlikely to fill the gap

We expect recycling to be structurally lower over time. Palladium must carry a larger portion of the recycling economics, as platinum and rhodium were materially reduced in autocats (catalytic converters for exhausts) after 2010. Given that palladium accounts for substantially less of the value in an autocat, recycling economics are likely to become structurally weaker going forward, as these lower-grade catalysts are not as profitable. Because of the nitrogen oxide (NOX) emission cheating scandal (‘Dieselgate’, circa 2015), the jury is still out whether the current autocat stockpile even has the assumed amount of rhodium. - Investment demand appears poised for inflows instead of redemptions

The price of platinum – which for the last century has had an approximate 1-for-1 price relationship with the gold price – is now close to an all-time relative low. We believe this relationship will drive incremental investment into physical platinum and ETFs. - Materially higher prices are needed to meet residual demand

Residual demand refers to the industrial use requirement not tied to the auto cycle. For platinum, that equates to roughly 4.5 Moz of the 7.6 Moz demand. To meet 2030 residual demand, SA’s long-life mines will need to stay in operation. But the long-life mines are also the more expensive mines, for example Amandelbult, Zondereinde, K4, Styldrift, 16 Shaft, etc.

Current cost support levels (80th percentile net total cash costs including stay-in-business (SIB) capital expenditure) are around R26k/oz for the 3E basket of PGM metals. At a reasonable (below historic trend) cost inflation scenario of 10% p.a. (elevated by electricity prices), costs will likely be around 60% higher by 2030. This cost base inflation sets the bar for future 3E basket price levels to be at a minimum close to sustainable. Given the current supply-side setup, it’s unlikely that the basket price can stay below the cost support level for an extended period of time, as was the case during the 2010s.

Our point is simply that there will be residual demand by 2030, and the market will have to pay more for these metals.

There will be winners and losers, with low-cost producers set to benefit

We do not expect all PGM miners to benefit equally from higher prices. Due to a rising cost base, high-cost producers are unlikely to earn higher margins. Meanwhile, newer shafts will be more mechanised and see less depletion. Hence, there will be margin growers and margin maintainers, meaning that investors have to be selective when considering investment.

In addition, PGMs tend to be found together in deposits, but the ratio of elements can vary by geographic region. This mined PGM ‘basket’ tends to lead to divergences in miners’ basket economics, with some standing to benefit disproportionately from platinum/minors (rhodium, ruthenium and iridium)/byproduct (chrome)-rich ore bodies, which represent up to 75% of selective SA miners’ basket economics. Considering the favourable SA supply-side setup linked to this proportion of the PGM basket, SA miners’ operating leverage to higher prices has the potential to be multiples of what we saw in 2021/22, led by rhodium and palladium.

We are poised to see a change in narrative

Battery electric vehicle (BEV) penetration projection scenarios have dominated media articles and narratives in recent years, and have contributed to bear case demand scenarios. Over the next five years, however, PGM supply will increasingly drive narratives, prices and profitability, rather than demand factors.

Given the strong supply-side underpin, our investment case is not overly reliant on autocat demand and BEV penetration assumptions. In fact, even with bullish BEV penetration assumptions (50% faster pace than consensus, reaching >35% of global light duty vehicle (LDV) production by 2030), we still foresee supply shortfalls.

However, a few scenarios provide very attractive upside optionality to our investment case. For example, what if, over the next five years, PGM auto sector demand proves more resilient as the true energy economics of hybrid drivetrains become better understood? What if countries move towards tighter emissions regulatory regimes requiring higher PGM loadings? These would be highly supportive of our investment case.

Patience will be required

PGM upcycles have historically been extremely rewarding, with 2x to 3x upside potential being very realistic. However, the exact timing is uncertain, and although the probabilities for favourable outcomes improve over time, the journey is likely to be marked by the high levels of volatility for which this sector has become well known.

Therefore, we carefully consider the inclusion of PGMs as part of our portfolio construction process, considering their risk characteristics in light of fund-specific mandates, investor risk tolerance, and time horizons to appropriately size positions.

Our clients have had healthy exposure to PGMs that has served them well this year, after the pain of the preceding two years. We have retained exposure despite the recent price recovery, as we see further upside potential, given our analysis.