11

September 2025

Finding hidden gems when stalwarts fall from grace

Kevin Cousins

Head of Research,PSG Asset Management

To achieve successful long-term investment outcomes, it is necessary to construct resilient portfolios with diversified drivers of return. ‘Stalwarts’ can provide a steadily growing component to equity portfolios, but there are few opportunities to buy them at attractive ratings. Where an investor is able to take a longer-term view, however, and buy stalwarts that have fallen from grace at depressed valuations, we see the potential for exceptional long-term returns.

To achieve successful long-term investment outcomes, it is necessary to construct resilient portfolios with diversified drivers of return. An important component of an equity portfolio is a holding in steadily growing ‘stalwarts’. These are high-quality companies whose revenue shows low elasticity of demand. In other words, customers buy their products or use their services even in tough times. They provide balance in a portfolio, to the more cyclical companies from sectors like materials, energy, industrials and consumer discretionary retail. Opportunities to buy stalwarts at attractive ratings are relatively rare, and generally involve the market consensus deciding the company is ex growth and no longer merits stalwart status. But where an investor is able to take a longer-term view, and buy stalwarts that have fallen from grace at depressed valuations, we see the potential for exceptional long-term returns.

Cornerstones of your portfolio

Stalwart companies are often found in sectors like cash retail, food producers or healthcare. They generally have a long track record of stable growth and are typically accorded a premium rating compared to the overall market. The key question is whether the depressed revenue growth or margins are the result of temporary issues, or whether there has been a permanent change to the economics of the businesses.

Our 3M process is an excellent framework to find ‘quality on sale’, and given that the market consensus is often based primarily on an extrapolation of the recent past, researching former stalwart companies tends to be an ‘opportunity-rich’ area for us.

The brewers’ fall from grace

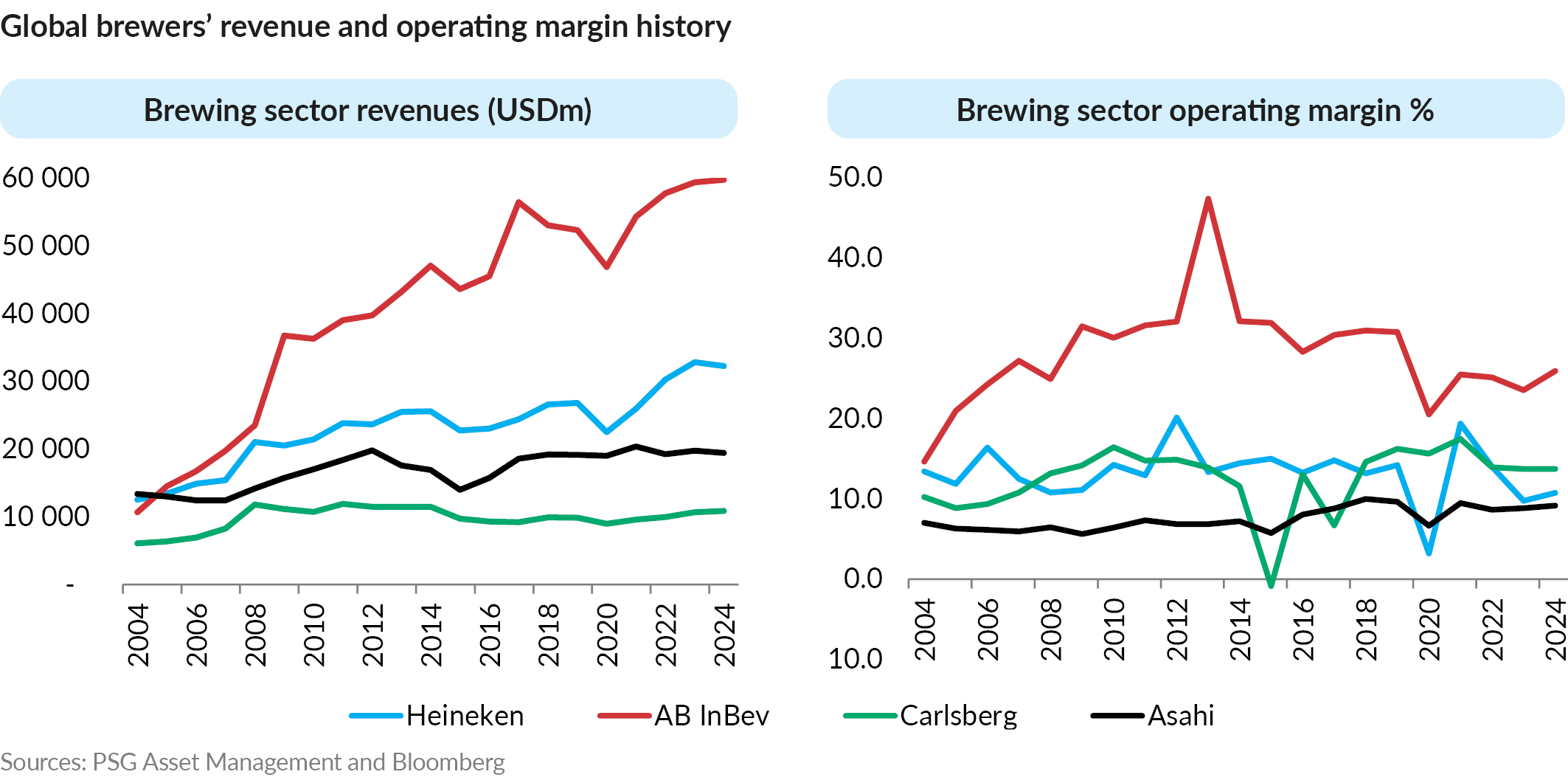

For many years, brewers were considered the epitome of a ‘steady grower’ stalwart. They traded at significant premiums to the broader market. However, muted revenue growth and pressure on margins over the past decade changed this, and the consensus view became very negative on prospects for brewers. Sector concerns included the following:

- Beer was losing ‘share of throat’ to wine and spirits.

- Younger, Gen Z consumers were drinking less or not at all.

- Weak emerging market (EM) currencies in important beer markets pressured reported USD revenues.

- The sector faced demographic challenges, with the key consumer cohort (25- to 45-year-old males) in decline in many markets.

- The impact of Covid-19 on on-premise revenues torpedoed the stalwart status.

- Increasing regulatory risk and health concerns.

- Legalisation of recreational cannabis use in some markets was seen to impact alcohol consumption.

- Margin squeeze from high raw material prices in 2022.

AB InBev was considered to be ex growth

In addition to these broad sector concerns, the world’s largest brewer, AB InBev, also worried investors in two specific areas. Firstly, they were perceived as driving growth primarily through acquisitions and subsequent cost efficiencies. Secondly, after purchasing SAB at a very high price in 2016, their balance sheet became heavily indebted. This prevented additional deals and hence created the perception that

AB InBev was ex growth. The quantum of their debt also called into question their role as a defensive portfolio holding given that investors often shun highly leveraged companies in periods of market stress.

Transforming an industry giant

In 2021, Michel Doukeris replaced Carlos Brito, who had been AB InBev’s CEO since 2008. While it is clear that ABI overpaid for the SAB acquisition, in addition to access to fantastic markets like Columbia, Peru and South Africa they gained immensely valuable intellectual property. The ‘Market Maturity Model’ and ‘Category Expansion Framework’ were developed by SAB’s Anne Stephens, who was retained after the acquisition and tasked with rolling these out at ABI. These provided the blueprint for a global brewer to drive organic growth. Markets are classified based on their economic maturity, and different strategies and ‘toolkits’ are used in each.

In SAB, country heads were immensely powerful, so rolling out strategic or operational changes was fraught with difficulty. In contrast, ABI does this extremely effectively, incorporating global best practice for each type of market within their incentive systems. Just as the group needed to refocus on organic growth, they had refreshed leadership with the model and framework to achieve this.

ABI is the dominant player in a very advantaged industry

After a long period dominated by negative narratives, investors tend to forget just how economically advantaged the global brewers are. Global brewing is immensely concentrated, with many of the world’s largest markets being dominated by a handful of companies. It is common for the top two companies in a market to have a market share well in excess of 60%. In addition to having very concentrated market positions, there is typically relatively little supplier or customer power, enabling ABI to have very wide margins and to run negative working capital (their growth is effectively funded by their suppliers).

This has enabled ABI to be very cash flow generative while investing in organic growth as their top capital allocation priority, followed by deleveraging. Gearing has now been reduced to acceptable levels. The return of capital to shareholders has begun, and UBS’s analyst expects share buybacks of US$2bn, US$3bn and US$3.5bn respectively over 2025, 2026 and 2027 as a base case. Their bull case has share repurchases rising to over US$5bn a year in the same time frame.

A return to consistent growth

While market expectations for long-term future growth are still muted, we see many factors that could drive positive surprises in the years ahead. Firstly, EMs make up about 70% of ABI’s market. While these markets have attractive demographics and good growth potential, their currencies have experienced a decade of weakness relative to ABI’s reporting currency, the USD. Sell-side analysts extrapolate this weakness into the future. We believe currencies go through long cycles, and assuming perpetual depreciation is overly punitive.

Secondly, ABI is actively growing the beer market, with beer once again gaining share against wine and spirits in many key markets. Kantar estimates beer category participation increased by some 6 million consumers across ABI’s top 12 markets in Q1 2025 alone. To do this, they have focused on what they call consumer ‘barriers to beer choice’. For example, the low-carb and low-sugar brands, epitomised by Michelob Ultra (now the second largest brand in the US), appeal to older consumers. No-alcohol beers are also growing very rapidly: smash hit Corona Cero is currently growing in triple digits. These, together with the ‘beyond beer’ portfolio of flavoured products, are incremental to the beer category (most consumers are switching from non-beer alternatives) and very profitable, with premium price points and low or no excise tax.

Loved beer brands the heart of the business

ABI owns 8 of the world’s top 10 beer brands, including Corona, which is ranked as the world’s most valuable beer brand. Corona is marketed as a premium brand globally (outside of its home market, Mexico), and averages a 20 percentage point price premium over Heineken in ABI’s top 15 markets. Corona appeals in particular to younger consumers, despite being a 100-year-old brand. Over 2 million people attended the first of its 100-year celebration concerts on the Copacabana beach in Rio earlier this year. It is one of the few global beer brands that is unisex in appeal, getting you double marketing ‘bang for your buck’, as it were.

Younger consumer cohorts have started ‘normalising’ their alcohol consumption habits as they reach their late 20s, and it appears the late start – compared to earlier generations – was impacted by both the Covid lockdowns and the tough economic environment.

The quiet digital transformation

ABI and listed subsidiary Ambev have made a huge investment in information technology over the past five-plus years. The tech team comprised 128 people in 2018 and, by 2022, had grown to some 4 000 professionals including 200 data scientists. ABI has digitised an incredible 85% of revenues using its ‘BEES’ app, which in Q1 2025 had 32 million orders and a gross merchandise value (GMV) of US$11.6bn. The information gained from BEES is transformational, and enables ABI to deliver very precise marketing and promotions.

Despite ABI having much wider margins than the other brewers, they invest a higher percentage of revenue in marketing and promotions than, for example, number 2 brewer Heineken. Given their higher turnover in most markets, this means their absolute spending budgets are huge in comparison. On top of this, BEES enables this large spend to be targeted more effectively, which will play a big role in driving brand power – and hence revenue growth – over time.

More levers for growth than other staples businesses

The brewers have a variety of routes to market (on-premise and in-home), an array of packs and pack sizes, and the ability to move consumers up a pricing ladder to more profitable premium brands or adjacencies as markets mature. This provides many avenues for revenue growth compared to, say, a branded food business. ABI also brews in-country, using domestic suppliers of raw materials and packaging as far as possible. This makes them very resilient in the new world of tariffs and trade wars. In addition, the brewing supply chain, from hop and barley farmers upstream to tavern owners downstream, employs a huge number of people – an important consideration for policymakers considering changes in legislation or tax.

Brewers are likely to play an important role in our portfolios in the years ahead

PSG Asset Management follows a globally integrated investment process, and it was fortuitous that ABI, which we consider as the most attractive opportunity, is dual-listed in South Africa. Our funds also have investments in the world’s number 3 brewer Asahi and Bud APAC, ABI’s Hong Kong-listed subsidiary.

We expect ABI to deliver good organic growth in the years ahead. There will obviously be fluctuations from year to year, but as a globally diversified brewer with excellent economics and now a strong balance sheet, ABI acts as a resilient cornerstone or stalwart investment. Management’s focus on rejuvenating the beer category, digitisation and capital returns add to the attractions. We anticipate the market consensus to gradually upgrade long-term growth expectations for the brewers and ABI in particular, which we expect to return to being a premium-rated business in years to come.